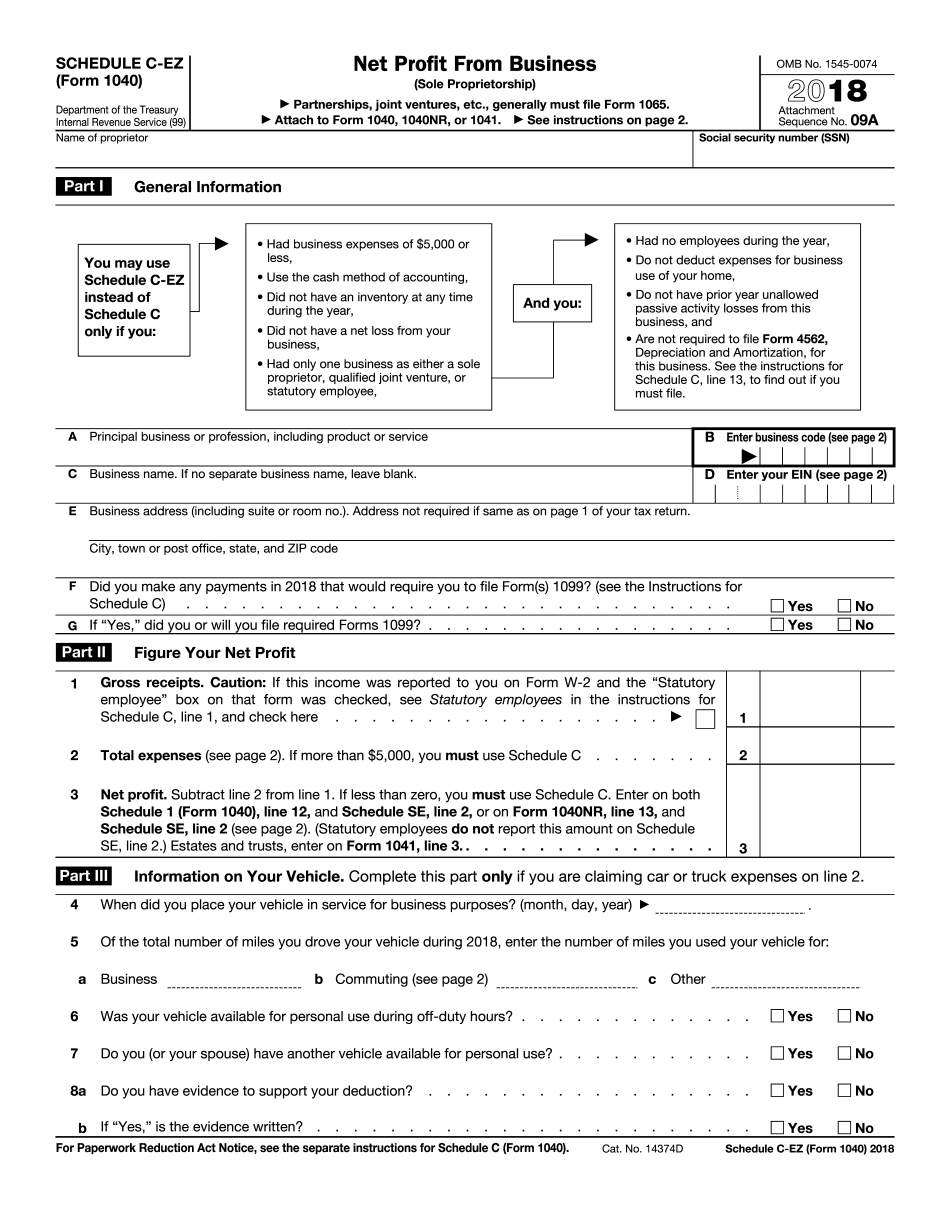

We're going to fill up schedule CEZ to simplify business form. Let's take it from the top, like on all forms. So, add our taxpayer's name and social security number next on line A. We're gonna fill in the type of business it is. In our case, it's consulting. Every business has a special code; we can find that in the instructions on page two. Let's enter that number in the right column. Since our business doesn't have any special name or address, we can skip line CD and go straight to filling in the gross receipts on line one. Our taxpayer made seven thousand dollars, and he had one hundred ninety-five dollars of office expenses. Let's total that up: six thousand eight hundred and five. He doesn't have any information regarding a vehicle, so he's done. Now that you've learned how to do this, wouldn't it be easier to let us do it for you? Brought to you by Wheezing Burgin Company.

Award-winning PDF software

1040 (Schedule C-EZ) Form: What You Should Know

If you're not a sole proprietor, it lists your sources of income and is generally used to figure your taxable income. It is not an additional tax form. All items on Schedule C-EZ are included in your gross income. You do not have to itemize deductions. You have to calculate your taxable income. In other words: Boxes 1-10: The Gross. In box number 1 you may report net income, income from sources outside the United States, gross profit, net loss, and your gross and net income. Boxes 11-29: The Notional. In box number 11 you will report what you would have earned had you been in business. In box number 12 you will report what you anticipate you will earn if you were in business in future years. In box number 13 you will deduct what you should have paid as wages, wages and other amounts paid as commissions. You will also deduct other amounts paid for expenses. Boxes 30-39: The Net In box number 30 you will report your net income. In box number 31 you will report net profit— net income less expenses. Boxes 40-49: Your Net In box number 40 you will report your net income. In box number 41 you will report your net profit. If you're a sole proprietor or self-employed, you will also have to report your deductions in a separate schedule (Schedule P) to report the interest you pay on investment accounts, charitable contributions, and other business expenses. Sep 19, 2025 — Tax season. Sep 20, 2025 — The due date. Pay the tax before the due date. You must pay the tax before the due date. This is sometimes called a pay-as-you-go (PAY GO) tax rule. A PAY GO tax rule gives you the right to withhold the tax but not to pay it before the due date. To pay the tax, use the “check box” instructions on line 19 of Schedule C-EZ (Form 1040). You do not have to file a Form 1040NR, Non-resident Alien Tax Return. Schedule C-EZ (Form 1040) has some additional rules that might apply to you. For example, you must use the “substantiate” checkbox on line 16 if you are a professional.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 (Schedule C-EZ), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 (Schedule C-EZ) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 (Schedule C-EZ) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 (Schedule C-EZ) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1040 (Schedule C-EZ)