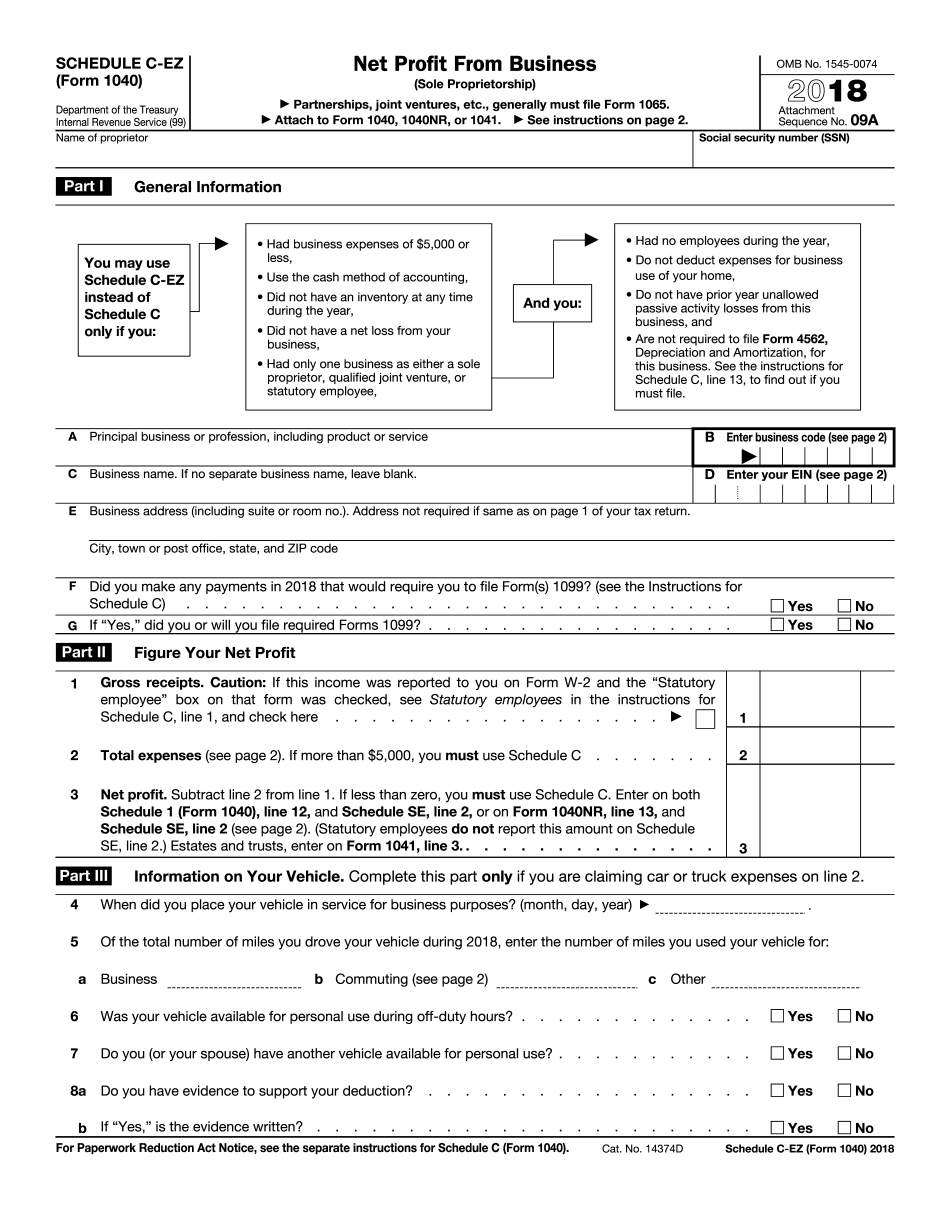

Hi, I'm Rex. For tax purposes, when reporting your income to the IRS, you will need to use either a Schedule C or a simpler version called the Schedule CEZ. On this form, you can also claim any expenses related to your business. If your net earnings exceed $400, you will also need to file a Schedule SE to calculate your self-employment tax. It is important to have appropriate documentation to support your income and expenses when filing your tax return. There are various deductions you may qualify for, such as home office expenses, transportation and travel expenses (both locally and away from your home business), professional and education licenses and fees, as well as office supplies. In order to claim business expenses, each expense must be considered ordinary and necessary, meaning it is common to your profession and contributes to the development or maintenance of your business. Current expenses are those that benefit your business for a period of less than a year. To be eligible for deduction, expenses must be reasonable in amount and should not be exaggerated. Net profit refers to the amount you have been paid for goods and services after deducting all eligible business expenses. For more detailed information, please visit the website eatacts.com.

Award-winning PDF software

Irs 2025 1040 Schedule C Ez Form: What You Should Know

Form 1040 (Schedule C)Profit or Loss from Business (Sole Proprietorship)2017 2018 Schedule C-EZ (Form 1040) — IRS Go to for instructions and the latest information. ▷ If you have a partnership, Form 1065 should read Sole Proprietorship. If you have a corporation, Form 5471. ▷ For a corporation, Form 2555 must show the corporation as the sole proprietor. Form 2555 must include: the number or designation of the corporation as sole proprietor and the filing status of sole proprietor (such as corporation, sole proprietorship, or S-corporation) and the filing type of any partnership income (such as partnership interest, partnership profit, or partnership loss) that may be included in the corporation's taxable income The corporation is also required to provide the correct income and cost basis. Sales in Qualified Real Property Sales in Qualified Real Property22 Sales in real property include those made or received for consideration for tangible personal property, including real property or assets used in a trade or business, and income from personal property used in the conduct of a trade or business or income from rental property. It includes property and transactions in which you or your spouse or partners own more than 95 percent of the interest or debt and in which you are treated as the sole owner of the property. Income on sales of personal property included in a sale or exchange of securities. (Form 1099-B). Taxpayers must calculate all of their sale or exchange income and expenses on a fair market value basis, since there are no commissions or fees in property transactions. Taxpayers don't have to treat all gifts and inheritances as sales for the purpose of determining the appropriate tax rate. Any payment in lieu of tax or payments made to satisfy tax indebtedness are sales and should be recorded in the year the payments are made. If property sold for other than cash is a trade or business, the seller's basis in the property is its fair market value. Sales of real property subject to tax, including sales of buildings, land, and mobile homes subject to the estate tax. (Form 1099-MISC). Taxpayers must calculate all of their sale or exchange income and expenses on a fair market value basis, since there are no commissions or fees in property transactions.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 (Schedule C-EZ), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 (Schedule C-EZ) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 (Schedule C-EZ) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 (Schedule C-EZ) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs 2025 Form 1040 Schedule C Ez