Okay, in this video, we're going to talk about how to fill out a 1040 EZ federal tax form. Now, the reason we're only focusing on a 1040 EZ is because it's the most common form that you will ever fill out when doing your taxes. Now, let's go and get started. What you're going to need is a W-2, a 1040EZ form, as well as the tax table. Now, I'm going to provide all of that on this video here, so if you have one of my worksheets or if you have something else that you can go along with, feel free. Let's go and get started, alright? Step 1: Use the W-2. Now, the W-2 looks like this. This is the form that you get every year from your employer. It tells you how much money you make, how much money you have paid in taxes (state, federal, all that). It's basically a snapshot or a progress report of how much money you've made financially for your job. So, the first thing I want to look at is how much money did you make. So, how much money you made was right here on the first line: seventy-six thousand three hundred and fifty. Now, going to my 1040 EZ, that's what I'm gonna put here: seventy-six thousand three hundred and fifty. Okay, now for this particular example and the ones that we're going to do in this class, lines two and three talk about taxable interest, meaning if you got money off of maybe a savings account or something, or line three is unemployment, just in case you didn't have a job but you're getting an unemployment check. That's what you would fill in for two and three, but we're just going to skip two and three, alright? Now, add lines...

Award-winning PDF software

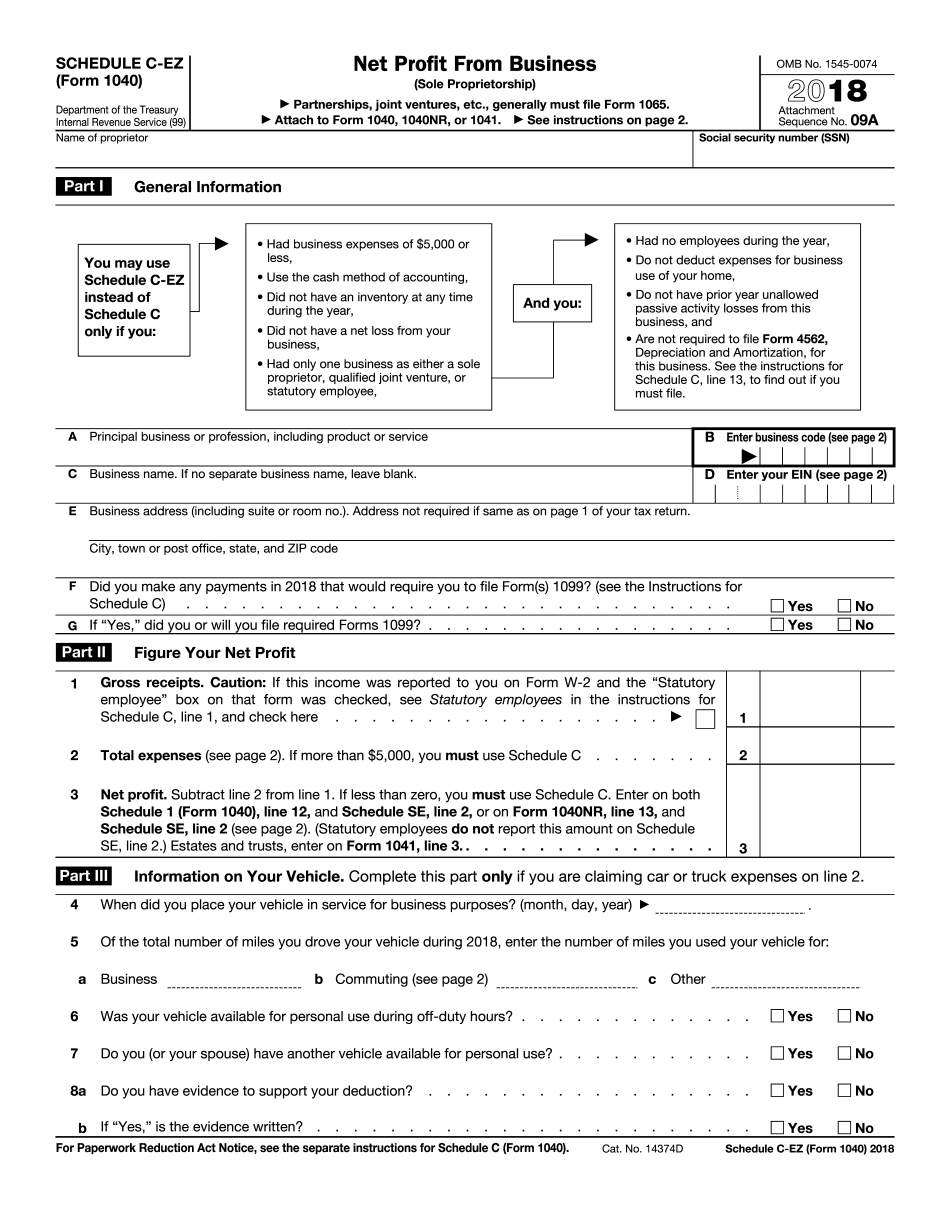

Schedule c-ez instructions 2025 Form: What You Should Know

Schedule of Federal Taxable Income. 2017. PRINCIPAL BUSINESS OR PROFESSION. MAIL, REGISTRATION, Form 1025T:Treatment of Tax Refunds for Individuals Other Than Resident Aliens See the instructions for. Form 1025T, which includes a summary of the tax you can claim and the amount you can receive, for a household, head of household or qualifying taxpayer other than an alien; see page 1 for more information. See the instructions, page 6 of the instructions for Form 1040-EZ, and, on pages 24–27, of the Instructions for Schedule EZ. Form 1040A:The 1040, Form 1040-A, and Form 1040-EZ (with supporting schedules) Form 1040-EZ (with supporting schedules) Schedule A, line 14, and Schedule E (with an accompanying Summary of Federal Income Tax) See page 1 of the instructions for Form 1040. If you filed a previous return, this page of the forms replaces the page you would be on at time of filing your corrected return(s). See page 1 of Form 1024R for details. Line 14 is your state/provincial income tax return, line 15 is you, your spouse, and line 17 is your dependents, if any. See the instructions for Schedule A for information about your filing status. Schedule C: Form 1040 (Schedule C) (for U.S. citizen businesses) Form 1040-EZ (for foreign corporations) See the instructions, Form 1040-EZ (with supporting schedules) and Schedule H–EZ (Form 1040) for information about the form you must file. Form 1040, Schedule C : Annual reporting by FISCAL YEAR (FISCAL YEAR ROUND B), and Schedule P-1 (with supporting schedules) : Annual income, expenses, and deductions (FISCAL YEAR ROUND B), and : Annual income, expenses, and deductions Schedule A : Annual income, expenses, and Schedule E : Form W-2, Wage and Tax Statement Schedule A, line 14: Annual income for U.S. resident aliens. If this is a small business in which you were not the sole proprietor, you must file Schedule C-EZ. A.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 (Schedule C-EZ), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 (Schedule C-EZ) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 (Schedule C-EZ) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 (Schedule C-EZ) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Schedule c-ez instructions 2025