Hi, this is Shane with Sparks Tech Services. In this video, we will be continuing our tax education series for truck drivers by discussing Schedule C Part Two expense deductions. But before we continue, don't forget to like the video, subscribe, and also hit that notification button so you'll be able to see all the videos that we will be releasing on Tuesdays, Thursdays, and Saturdays. This is actually Video 2 for Schedule C Part Two expenses. Our first video was about tax forms for owner-operators. If you haven't seen that video or missed it on Tuesday, no worries. The link will be in the description for you to watch it. You may be asking yourself, "Am I considered an owner-operator?" I'm going to help you answer that question. If you received a w-2 from the business or businesses you drive for in 2017, you are considered a company driver. On the other hand, owner-operators receive a 1099-MISC form. If you received that form, this video is for you. Now, if you're a company driver, I think you should still hang around. It's a short video, and there may be some things you can use while filing your taxes. So, what is an owner-operator? An owner-operator is considered an independent contractor. That's why you receive a 1099-MISC form. Basically, an independent contractor is an individual in business for themselves. You are considered a sole proprietor. We talked a little bit about the Schedule C and tax forms filed by owner-operators in our previous video, and I just want to mention it again. Today, we will focus on the section we are going to start with on the Schedule C. The Schedule C is a profit or loss form that businesses or sole proprietors use to report their income or loss. Because you are an...

Award-winning PDF software

2018 schedule c Form: What You Should Know

The Massachusetts Office of Tax Analysis has prepared these forms. 2018 Massachusetts Qualified State and Local Sales and Use Tax Return (Form 1072): Business These forms are the sole responsibility of the business person and the filing owner. Please read “Business Tax Forms.” 2018 MA State Standard Deduction Form OLD 1040G (Download Form OLD). Note: This form must be filed with the Internal Revenue Service using Form 1040A/MISC to determine eligibility for the Massachusetts income tax deduction and for the Massachusetts credit for sales, use, or other tax paid to and expenses directly incurred in support of qualifying community property in Massachusetts. 2018 Massachusetts Earned Income Credit : Qualifying Family Taxpayer, 2018 Massachusetts State and Local Sales and Use Tax Return. Filing owner must complete Form 5498. 2018 Massachusetts Standard Deduction Form OLD 1040G (Download Form OLD). Note: This form must be filed with the Internal Revenue Service using Form 1040A/MISC to determine eligibility for the Massachusetts income tax deduction and for the Massachusetts credit for sales, use, or other tax paid to and expenses directly incurred in support of qualifying community property in MA. Filing owner must complete Form 5498. Filing owner must be an individual (married, filing a separate return); filing spouse should be filing as a family member under a shared filing agreement with a qualifying family tax-payer. 2018 Massachusetts Standard Deduction (2) (Download Form 5498.pdf). This form is to be presented on the state tax return (Form 1040) and does not apply to property tax. Please complete this form only if you itemized deductions on the 2025 Schedule A. Please review the instructions here for additional information on the filing format. 2018 Massachusetts Medical Expense Deduction (Download Form SS-40) (Filing owner must be a Massachusetts resident.) This form must be attached to Form 1040, 1040NR, or 1040A, or filed on line 5 of Form 1045. It is an entitlement to the MA medical expense deduction if you were a Massachusetts resident, and you paid medical expenses for yourself or a member of your family, including health insurance premiums, out-of-pocket costs, or deductibles in excess of 2,000 for personal expenses. The filing owner must not be a person with more than 5,000 deducted for medical expenses. Filing owner must submit a certification of the 2,000 limitation on medical expenses.

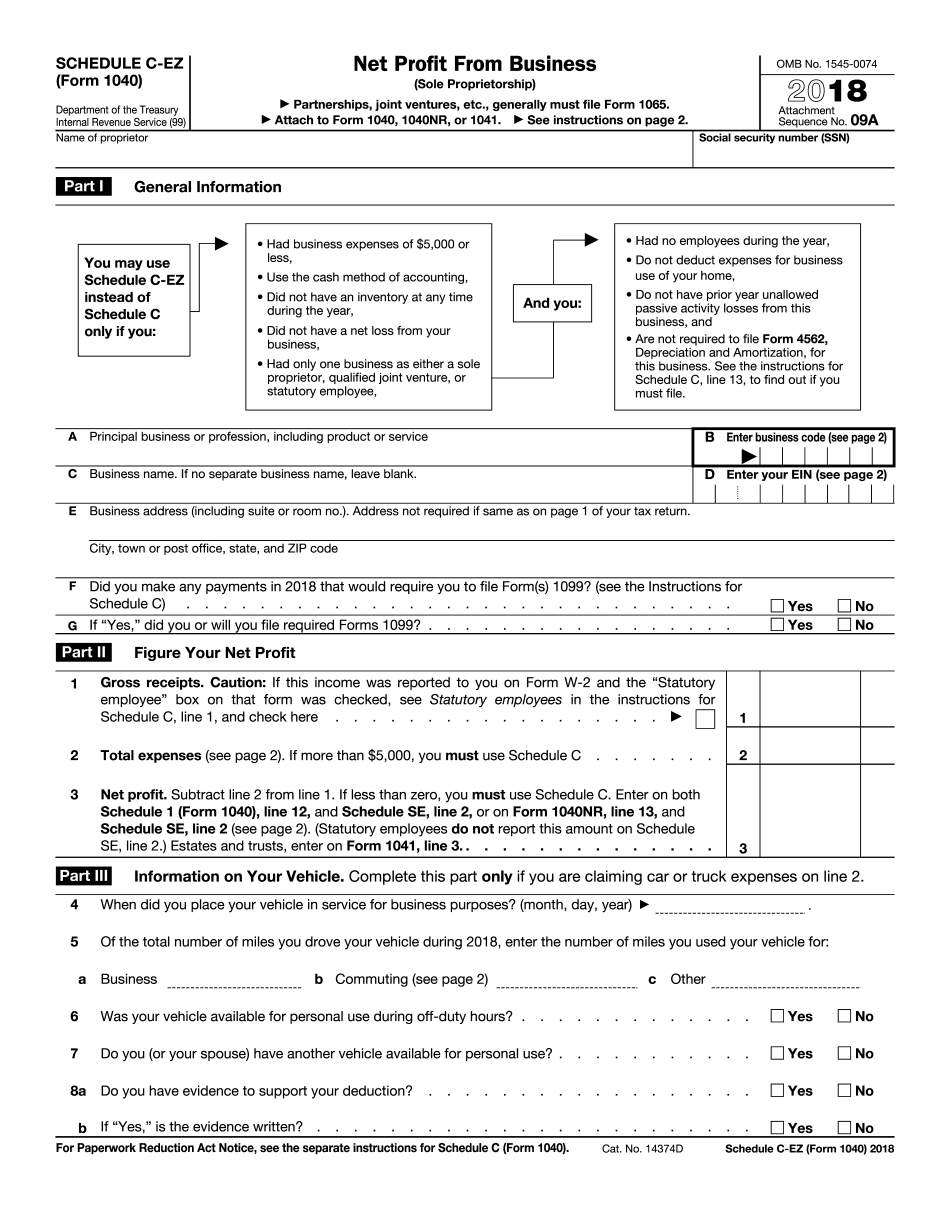

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 (Schedule C-EZ), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 (Schedule C-EZ) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 (Schedule C-EZ) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 (Schedule C-EZ) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 schedule c