Award-winning PDF software

Lesson 2 - Schedule C And Other Small Business Taxes: What You Should Know

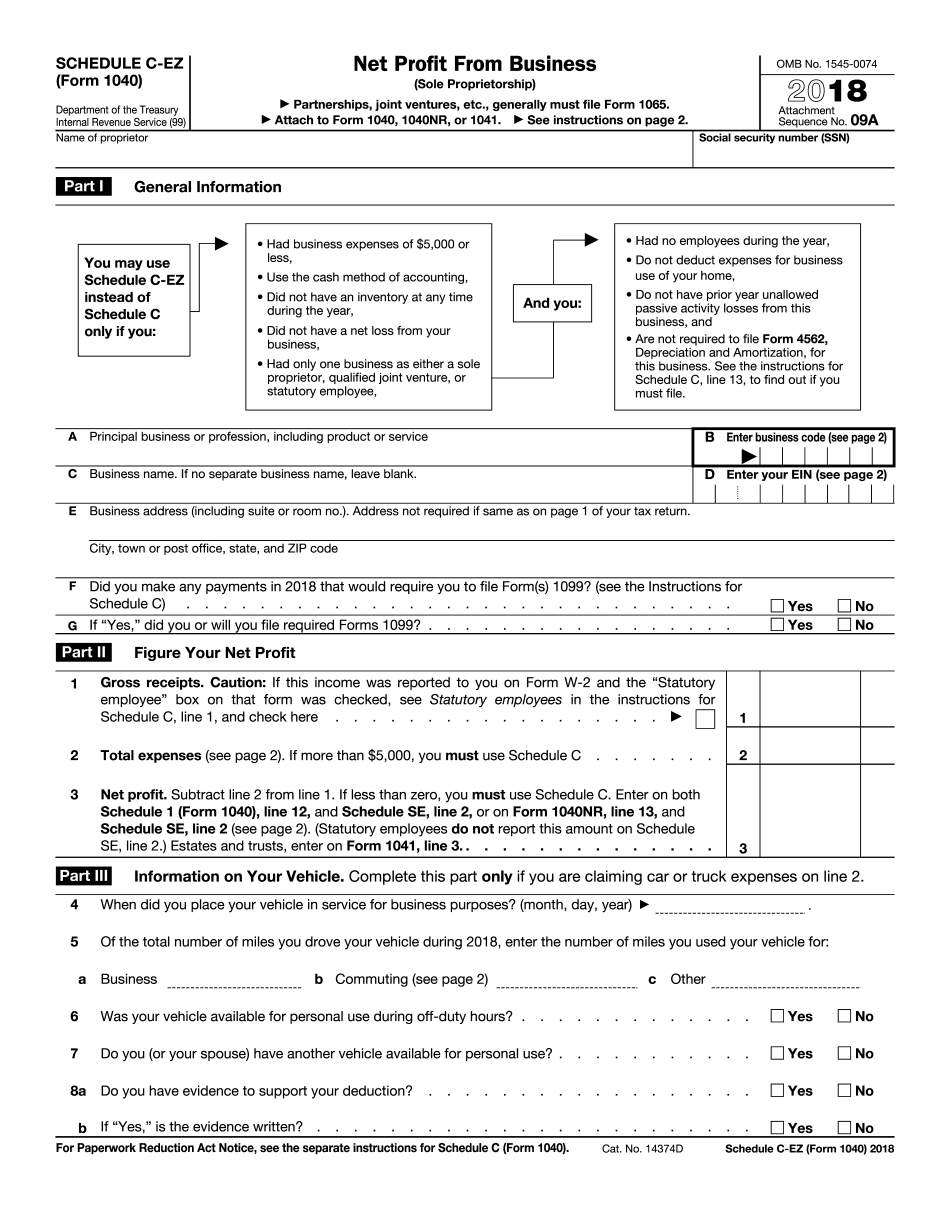

Video: What is Schedule C-EZ: Profit or Loss from a Business? TurboT ax Blog.

Online answers make it easier to to organize your doc management and increase the efficiency of your workflow. Comply with the quick guideline with the intention to total Lesson 2 - Schedule C and other small business taxes, stay clear of faults and furnish it inside of a timely manner:

How to complete a Lesson 2 - Schedule C and other small business taxes internet:

- On the web site together with the variety, click Start off Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your individual information and facts and contact info.

- Make positive which you enter appropriate material and numbers in correct fields.

- Carefully look at the material of the type at the same time as grammar and spelling.

- Refer to assist portion for people with any queries or handle our Guidance group.

- Put an digital signature on your own Lesson 2 - Schedule C and other small business taxes with all the guide of Signal Resource.

- Once the shape is finished, press Accomplished.

- Distribute the ready kind by way of e mail or fax, print it out or conserve on your own unit.

PDF editor will allow you to make adjustments in your Lesson 2 - Schedule C and other small business taxes from any on-line related product, personalize it as outlined by your requirements, indication it electronically and distribute in several methods.