Award-winning PDF software

F1040Pdf - Lsu: What You Should Know

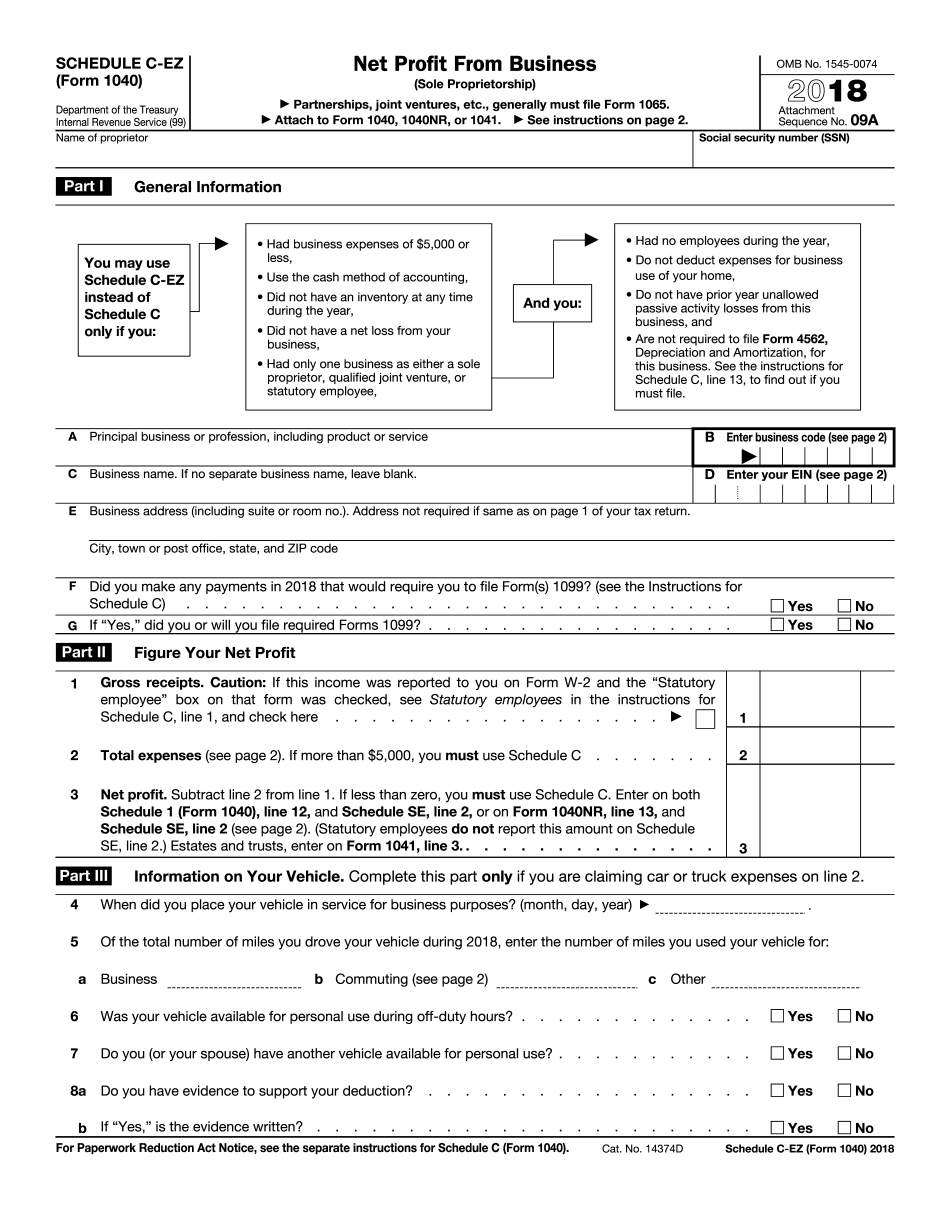

You can add a few more things: Personal income tax return for self-employed (or Schedule C). Personal or financial accounts. Business investment or sale records, real estate, partnerships, etc. The IRS doesn't care about what you do with it; you have to pay 1040 when you file your taxes — that's the law! If you don't file, however, the IRS can audit you, so have your copy in a safe place. I had to go back and add a few more things — and it's a good idea to get your copy of the tax form for federal tax. Here's the link, if you'd like to get more details: — Michigan 8. Tax on the transfer of real property for tax year 2016. You can choose to take the real estate tax deduction, if you have to. In 2016, a deduction for the real estate transfer tax is possible under certain circumstances. The minimum deduction per person is 2/3 of your adjusted gross income (AGI) for the current year less any allowable depletion or amortization deductions. For property transferred in the prior taxable year, the minimum deduction is 1/2 of AGI. For more information, see Publication 514, Land and Buildings, Real Estate. Also, see Publication 11, Sales and Other Dispositions of Assets, in Chapter 5, Taxable and Nontaxable Income (Form 1040). Personal incomes Tax on Real Property : If you are transferring the property for tax year 2016, your total income from sales, interest, dividends, annuities, and estates is taxable at the same rate as income from taxable sources. You may not claim the real estate transfer tax deduction. This means that you must pay the real estate tax on the property. The real estate tax rate in 2016, as amended by 2015, is 0.55 percent of the fair market value of the asset, or 28 percent if the property is qualified residential housing. Qualifying housing may include: • a unit to be used for housing purposes • a unit used as a principal residence If you have to pay the real estate transfer tax, you must report all of your gain or loss on the tax return for the most current year. You may be able to report gain or loss on the tax return for only one of the two tax years.

Online choices make it easier to to arrange your document administration and increase the efficiency of your workflow. Follow the quick handbook in order to comprehensive f1040pdf - LSU, keep away from errors and furnish it inside a timely method:

How to finish a f1040pdf - LSU on the internet:

- On the web site with all the form, simply click Start off Now and move towards the editor.

- Use the clues to complete the relevant fields.

- Include your individual data and contact knowledge.

- Make positive you enter correct details and quantities in acceptable fields.

- Carefully test the subject material from the type in the process as grammar and spelling.

- Refer to assist section if you've got any inquiries or handle our Assistance crew.

- Put an digital signature on the f1040pdf - LSU with the assist of Sign Device.

- Once the shape is completed, press Carried out.

- Distribute the ready sort via email or fax, print it out or preserve on your own device.

PDF editor enables you to make alterations to the f1040pdf - LSU from any on-line connected product, personalize it in line with your needs, indication it electronically and distribute in various methods.