The IRS Form 1040EZ The IRS Form W-2 Wage and Tax Statement (Form W-2) with a

Gov. The IRS Form 1040EZ The IRS Form W-2 Wage and Tax Statement (Form W-2) with a Balance Due and a Statement Attesting That the Amount Has Been Made Available to The IRS The IRS Form W-2, Wage and Tax Statement, with a Balance Due and a Statement Attesting That You Paid the Amount The IRS Form 1099 Wage and Tax Statement (Form 1099-MISC) with a Balance Due and a Statement Attesting That the Amount Has Been Made Available to The IRS The IRS Form W-2F Wage and Tax Statement (Form W-2F) with a Balance Due and a Statement Attesting That You Paid The Amount Form 1099-R, Return of Foreign Earned Income (Form 1099-RR) with a Balance Due and a Statement Attesting That The Amount Has Been Made Available to The IRS Form 1098, U.S. Individual Income Tax Return (Form 1098-ER) Form W-2G Wage and Tax Statement (Form W-2G) With a Balance Due and a Statement Attesting That You Paid the Amount Form W-2G-E Tax Statement of Employment Income (Form W-2G-E) With a Balance Due and a Statement Attesting That The Amount Has Been Made Available To The IRS Form W-2G-G Tax Statement of Self-Employment Income (Form W-2G-G) With a Balance Due and a Statement Attesting That The Amount Has Been Made Available To The IRS Form 1120-PR, Summary of U.S. Federal Income Tax Withholding for Individuals With Respect to Taxes Paid, With Information on Reporting and Exemption Form W2-WAGE Wage and Tax Statement (Form W2-WAGE) With a Balance Due and a Statement Attributing to the Company the Adjusted.

You hold a title insurance policy in respect of the property; this policy

For the purpose of this schedule, we will treat you as a single taxpayer from the day your return is filed until you file your most recent return on a timely basis. If you are planning on filing your return online or by telephone, you should contact either the Canada Revenue Agency or your financial institution as soon as possible to schedule the return so that your financial institution will update your account accordingly. If you are preparing a late return, we need to know as soon as possible whether you need to file an amendment or whether you can complete the return electronically before it files. If you are not sure whether you need to file an amendment or if you can complete an electronic return, you should contact us for advice. You are the legal owner of the property and there are no other legal owners of the property. You hold a title insurance policy in respect of the property; this policy provides that: you have coverage for the loss of the property from your own inventory of the property, you have coverage to compensate you for any property loss that results from accident, fire, or theft or that might otherwise be caused by you, you would be liable for the loss that would result if the property were destroyed or converted to other uses without your permission; and Your coverage would apply whether you are actually harmed by the death, physical injury, or loss of any real or personal property that you may own. If you have a title insurance policy in.

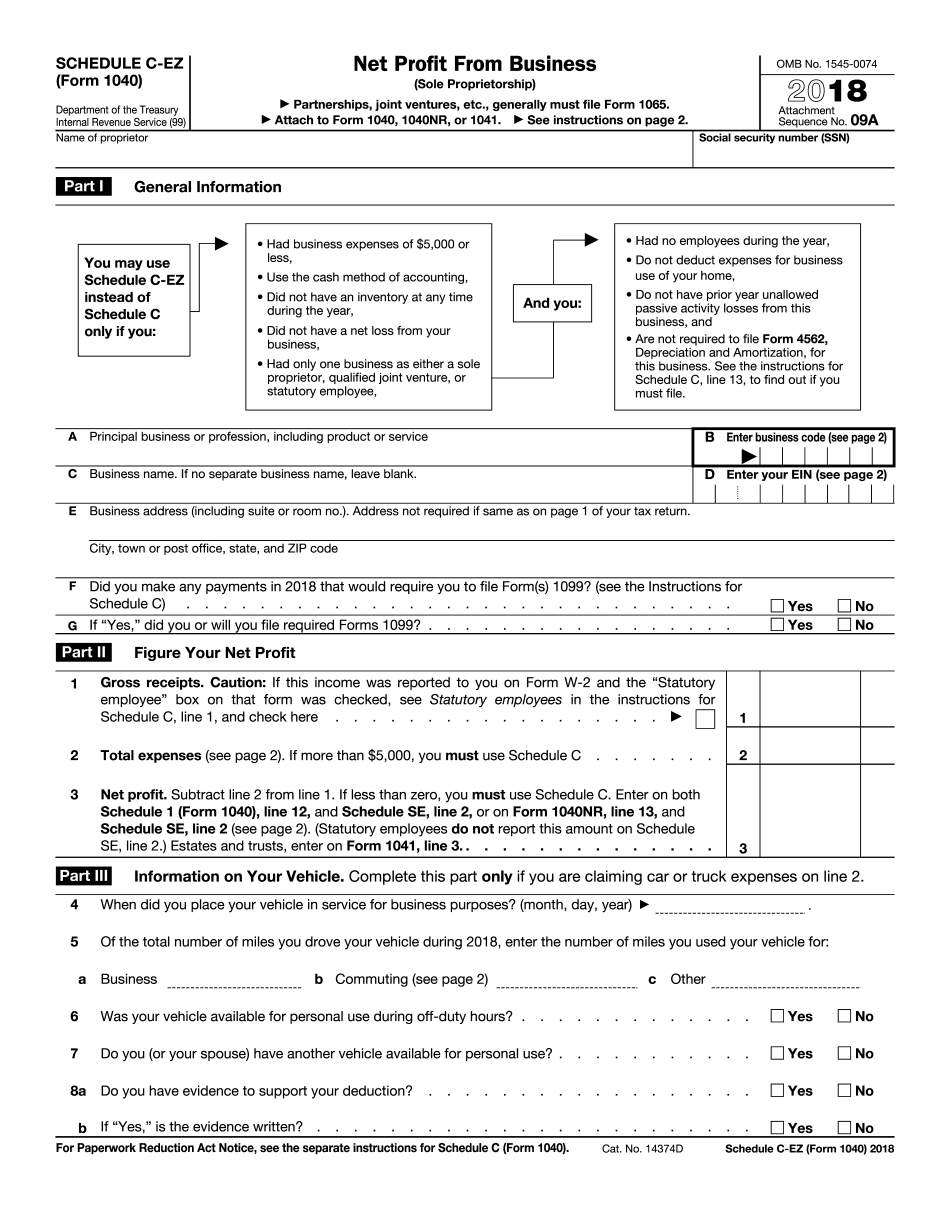

A full schedule of the new forms (C-EZ and J-4) may be found on the Formal

C-EZ and Schedule J-4 are available. A full schedule of the new forms (C-EZ and J-4) may be found on the Formal Instructions for Medicare Part C. (U) Schedule I-Pharmacy (FDA Approval) For Prescription Drugs. The following medications should be prescribed before the CPT code is written. The drugs should be prescribed to a prescriber authorized to dispense them by Medicare. If the prescriber is an ineligible prescriber, a patient may request a letter stating that the doctor cannot write the code. If the patient has a Medicare Part A or ACI, the CPT code will be exempt from drug review under Part 1 of Part O of Subpart O of Part 1220 of Title 44, Code of Federal Regulations. The following types of CPT codes are exempt from drug review under Part 1 of Part O of Subpart O of Part 1220 of Title 44, Code of Federal Regulations: CPT code 1120 (Vicodin CR) CPT code 1220 (Zopiclone CR) CPT code 1405 (Lopressor CR) CPT codes 1411 to 1418 are considered “general” prescriptions for CPT purposes and are not excluded from drug review (e.g., the “general” codes are not excluded from drug review under Subpart O of Part 609 of Title 44, Code of Federal Regulations under Part 609.40 of that Title). (U) Formal Instructions for Medicare Part C. For more information, visit. For example, for Form 1550, Form 1560 or Form 1570, complete the applicable information on its face and on its back and sign the form. CPT codes are electronically stored as individual medical records. This.

The Schedule C is a form your employer uses to request certain information

The Schedule C is a form your employer uses to request certain information from your income tax return. You are not being asked for a lot by the IRS, but you should have it filled out if at all possible because in some cases it forms part of the foundation for your tax liability. Read.

Minnesota Annually, you must file a Minnesota form with the appropriate

Minnesota Annually, you must file a Minnesota form with the appropriate taxes, income, and exemption totals. The Forms MSPT-4-C & MSPT-4-E. Minnesota Personal Income Tax forms and instructions. Texas Form 1099-MISC. Texas personal income tax forms and instructions. Utah Annual reporting and filing. Utah personal incomes tax forms and instructions. Vermont Annually, you must file a Vermont form with the appropriate taxes, income, and exemption totals. Vt. Stat. Ann. Tit. 13, sec. 13C § 20.2V (2018). Washington Each of your employers is required to file a single federal Form W-2 which must be signed by both of you within 10 days of each month. Each employer that makes over 118,532 is required to file form W-2G. W-2G forms and.

Award-winning PDF software