Award-winning PDF software

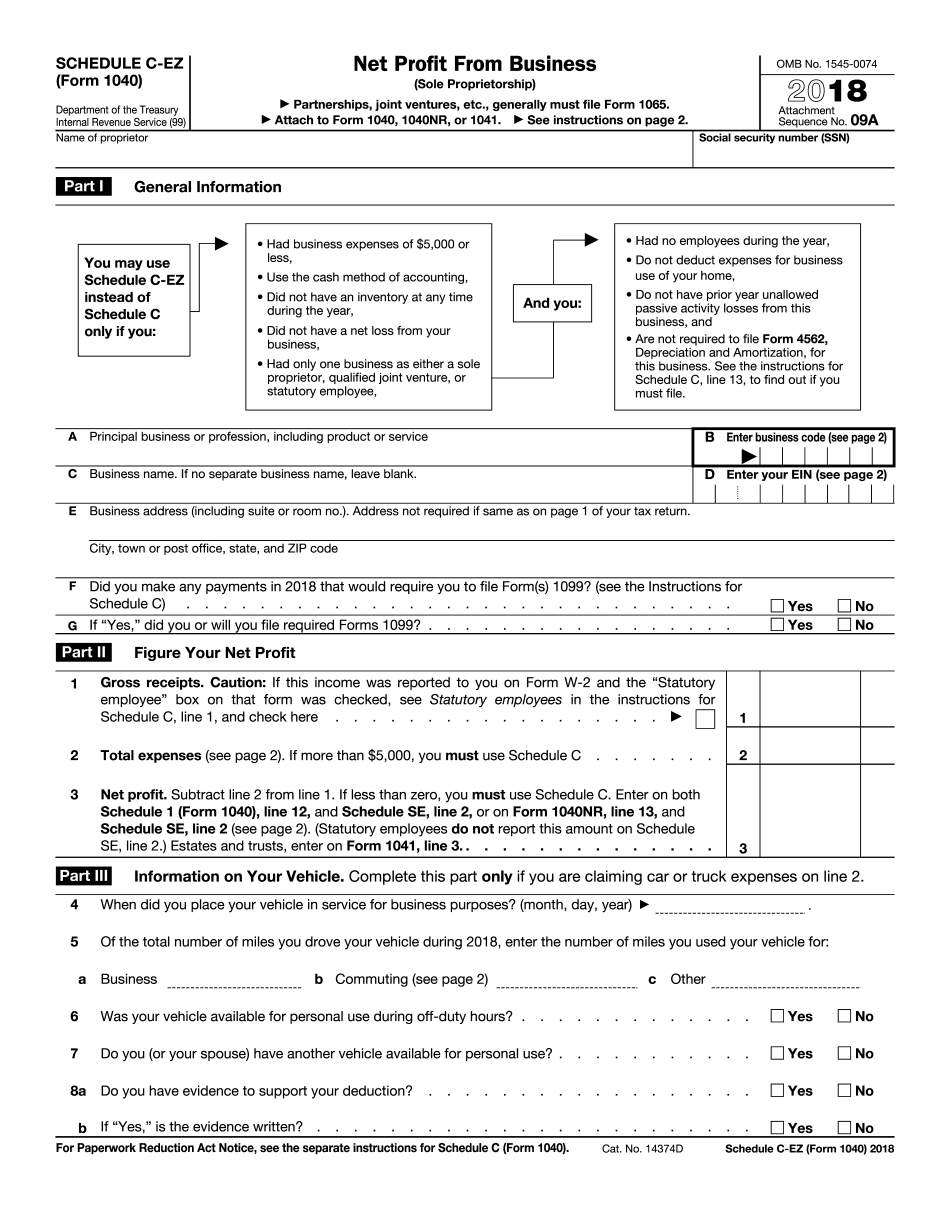

About schedule c (form 1040), profit or loss from business (sole

Report your net unrealized gains on Schedule F, Part I, or Part II of the Form 1040. The following expenses are general business expenses and not deductible expenses. This includes expenses you incur while in regular attendance at your employment of an employer. Also include these costs whether paid or not when you claim certain business expenses in the Form 1040. You generally must claim the business deduction in the year it is made. Your total income from the business equals the entire taxable year's total self-employment income from the business. Whether you claim an itemized or regular deduction, you can deduct only the amount of the business expense that is more than the limit. Income from a business for the tax year is determined if you itemize or claim the standard deduction. For certain business expenses, include the costs in your year-end income. Some businesses, however, may be subject to net operating loss limitations..

Video: what is schedule c-ez: profit or loss from a business?

Form W-2 shows the income and expenses of your employment (not your self-employment activities). Filer's name Date of birth Number of dependents Gross income Other types of employment income/expenses Self-employment income/expenses deducted from wages Self-employment expenses Adjusted gross income Form 1040 A-EZ APZ Income from employment Income from self-employment Qualifying business activity Adjustments for Social Security and Medicare Taxes Other information 1) Filer is married filing separate for less than one year or if filing as head of household. 2) Filer earned a profit less than 400,000 for the taxable year ended on or before January 1st, 2015, including the profits on all sales of tangible personal property and any other income or income from sources in the United States or its territories. 3) If the gross income for 2015 is below the 600,000 limit shown in Schedule B for the year prior to the taxable year, the Form 1040 form must be used..

Schedule c-ez (form 1040), profit from business (sole proprietorship)

If you are paid in cash or check, a copy of your federal income tax return is required to have your Schedule C ready. There's more information on my blog post about reporting the sale of shares of your company. 5. Schedule B — Business Investment or Loss For individuals, the only way to report a business investment or loss is through Schedule B. Unlike Schedule C, Schedule B is only available to sole proprietors, small business owners and certain other business tax filers. Schedule B includes both business and self-employment earnings from your business. While we do not offer this option for sole proprietors as of now, we hope to offer it in the future. If you prefer, you can use Schedule B instead of Schedule C. If you own your own business, you won't have to worry about not having a Schedule C or B because all of your income and.

Federal form 1040 schedule c-ez instructions - esmart tax

It can include wages, salary, tips, or any property transferred from an employer (for more information, see my post on the tax implications of being self-employed.) However, deductions are not deductible. Don't forget that your deductions are limited by the limits of itemized deductions. For more information, see “Taxes.” Some tax benefits are provided by the tax exclusion of medical expenses, but they are subject to limitations. For more information, see my post “The D&D Rule.” The D&D rule allows for an unlimited deduction of reimbursed expenses (those above 100% of adjusted gross income). This is important because, in some cases, non-cash expenses are very important to your tax strategy. Thus, it is important to know the rules to take advantage of the exclusion. You must limit your non-cash deductible expenses to at most 25% of adjusted gross income (AGI). So, if you earn an adjusted gross income of 100,000, your non-cash deductible.

Completing and filing schedule c-ez - the balance small business

PDF) ready for them to fill out and file by the deadline. Make sure you have all the required schedules before you file, don't wait to file the required IRS schedules. Remember, it makes no sense to file the 3-3-3 Schedule C when you are using a personal computer. You will have to use a paper form for this year, not an Excel spreadsheet. Don't do it. For more on Schedule C, see the IRS guide to Schedule C, which has links to all the schedules. And, of course, it's a good idea to have all of your receipts, all of your books, all of your letters and other written information ready so that you don't have to deal with your IRS tax situation on the fly. For years, I would have to try to get things straightened out in my tax account while I was at work, so I had to.