Award-winning PDF software

Form 1040 (Schedule C-EZ) online Clovis California: What You Should Know

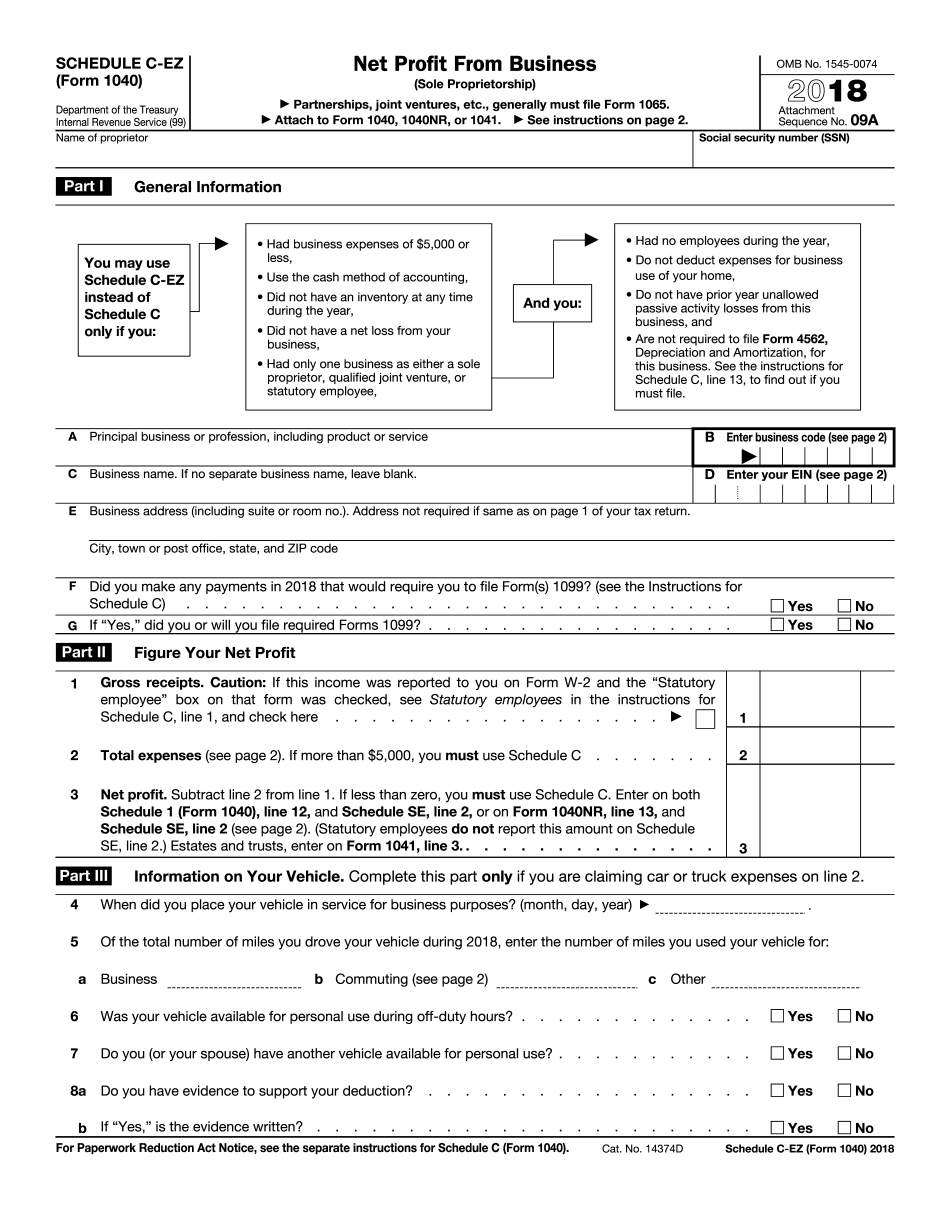

Use the Schedule C (Form 1040) to report income or loss from a business you conducted solely or through the services of another private corporation. 2021 Schedule C (Form 1040) — IRS Go to for instruction and the latest information. Enter expenses for business use of your home or business property only on line 30. 10. Advertising. You must obtain a certificate of eligibility for a Section 501(c)(3), (c)(6), (c)(7), (c)(8) or (c)(11) organization if your advertisement consists of one or more of the following: a) an appeal or statement regarding an individual, business, nonprofit corporation, political committee, or candidate; (b) a list of individual contributors who contributed more than 200.00 to an election or campaign during the previous calendar year, provided that the total of such contributions to file with the Commission and the contribution limits on file with the Secretary of State does not reach or exceed 100.00; (c) lists of individuals who are members of any organization; and (d) appeals, statements, or lists of individuals who are members of any organization and a description of the organization's general purpose. 11. Reporting a gift. You must report all gifts of personal property (other than cash and securities) received by you or on your behalf in the calendar year and on or before January 31, 2017. You must also file a report each January 31 for each calendar year that the gift was received, not to exceed 15 total reports during the year. A Form 5471 (Non-Business Gift) is required to report gifts of personal property to charitable organizations and the spouses of donors. In addition, Form 5471 (Non-Business Gift) is required to report any other gift (other than a gift of cash or securities) received in any calendar year other than by you or the gift recipient. 12. Business Partnerships, Limited Liability Companies (LCS) and S corporations. You may own a partnership, limited liability company (LLC), or sole proprietorship and must file Schedule C (Form 1040) if you operate a business under one or more of these arrangements. Generally, business partnerships, limited liability companies (LCS), and sole proprietorship are treated as sole proprietorship for these purposes. For joint-venture partnerships, the owner of each interest must file a joint Schedule C and Schedule C-EZ.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040 (Schedule C-EZ) online Clovis California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040 (Schedule C-EZ) online Clovis California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040 (Schedule C-EZ) online Clovis California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040 (Schedule C-EZ) online Clovis California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.