Award-winning PDF software

Form 1040 (Schedule C-EZ) online South Fulton Georgia: What You Should Know

Pennsylvania's property tax rebate program was established in 2025 as a way to offset property taxes, so long as the property has been in your possession for more than 7 years, and you maintain the property permanently. The program offers tax reductions of 450 to 2,000 for property tax-paid property and additional benefits for those who do not itemize deductions or have relatively low income. 2021 Georgia Property Tax Rebate Program The following programs are administered by Georgia taxpayers who make payments of up to 50% of the estimated tax attributable to the gross amount of their property in Georgia. The average rebate amount is 2,500. The Georgia Office on Government Services (“GOES”) has initiated these rebate programs on behalf of the State Revenue Development Division to enable low- and moderate-income Georgians to participate in tax-preferred savings opportunities. The rebate program is being promoted with a media campaign and targeted advertising campaigns. Rebates are available for the residential property tax and the nonresidential property tax, including the rental property value. A qualifying property can be any property owned on or after December 7, 1996, and before June 30, 2001. The rebate will be based on a property's assessed value, its current tax bill, and the total number of years the property has been in a tax-preferred savings account in Georgia. The average rebate amount available in Georgia is 2,500. The maximum rebate amount available for real estate is 16,000. 2033 Georgia State Pension 2033 Florida Tax Preparer Tax Credit 2033 Louisiana Business Income Tax Credit Schedule A — Alabama Tax Preparer's Tax Credit Complete Schedule A (Form 1040) or Form 1040A (Form 1040NR), Schedule K-1 (Form 1040A) Part 2. Payments can be made by check or money order payable to the U.S. Department of the Treasury, Office of the Chief Actuary (OCT), c/o Department of the Treasury. Form 1040, Schedule A is a tax return information return for tax year 2016, 2025 and 2018. The form may also be available from the Alabama Tax Commission.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040 (Schedule C-EZ) online South Fulton Georgia, keep away from glitches and furnish it inside a timely method:

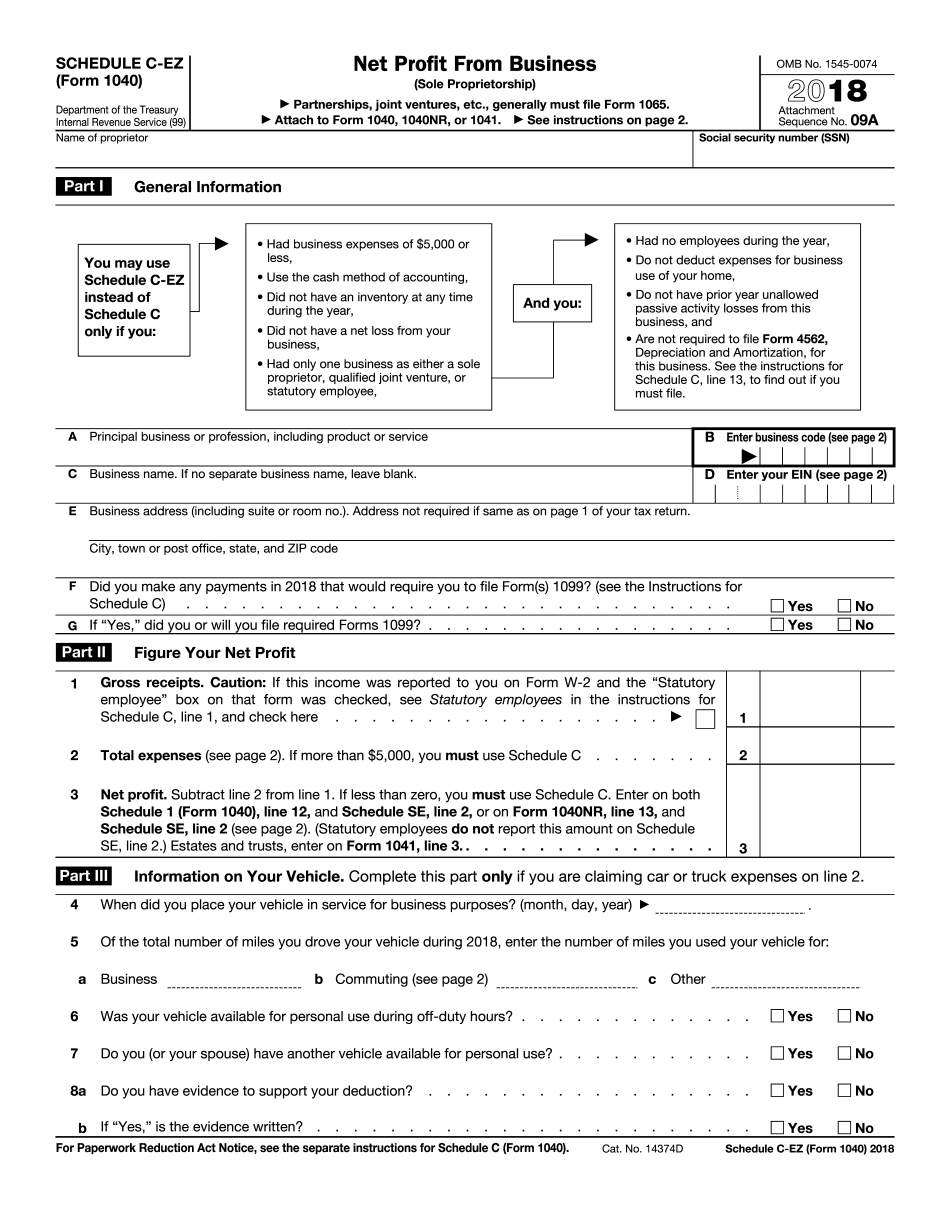

How to complete a Form 1040 (Schedule C-EZ) online South Fulton Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040 (Schedule C-EZ) online South Fulton Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040 (Schedule C-EZ) online South Fulton Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.