Award-winning PDF software

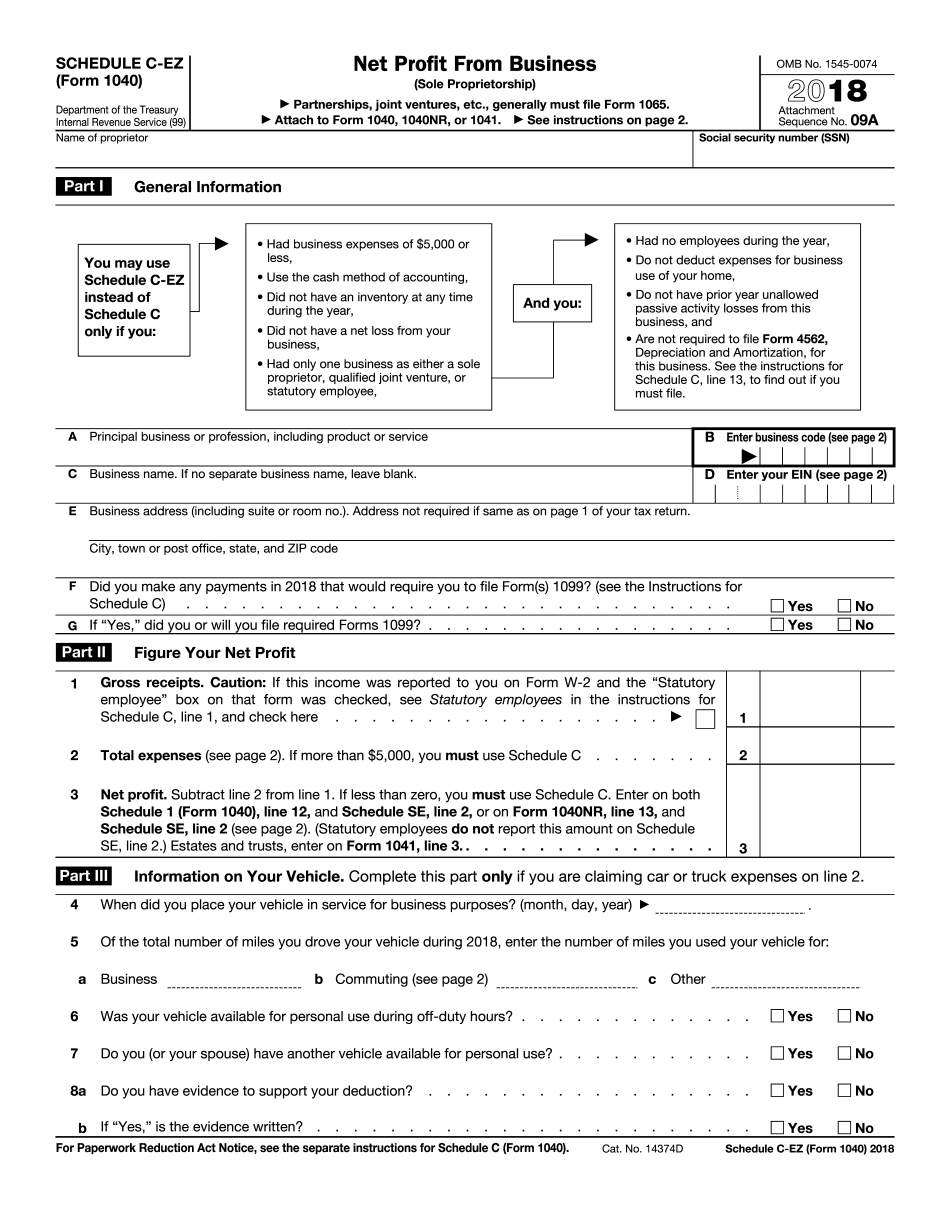

Salinas California Form 1040 (Schedule C-EZ): What You Should Know

Call or email our customer service department, at. · Home Loan Calculator. Enter interest rate, payment terms, loan term, and property location from the list or input your own. · Monthly H&R Block Quarterly H&R Block Monthly Loan Payment Payments on Schedule 9(a). Monthly mortgage payments can be submitted by mailing or fax to your local H&R Block office. Tax Pro — Federal Credit Union Federal Credit Unions are federal tax-exempt, tax-saving credit unions. Our members benefit from tax-deductible banking fees. Credit Unions can handle a wide range of financial and tax planning needs, including: • Mortgage • Credit cards • Insurance • Retirement fund and employer retirement plans • Tax preparation • Capital gains and dividends • Taxes on annuities • Home equity loans and lines. . . Home Loan Calculator, Loan Calculator, Mortgage and Loan Calculator. Home Mortgage Calculator, Mortgage Calculator, Mortgage Calculator Tax Pros — San Diego Association of Realtors Assoc. Realtors provide home inspections to home shoppers of all walks of life. We do home inspections for a wide range of housing issues, from mortgage applications to home repair issues, so that everyone is on the same page when they buy or sell their homes. Realtor.com is a searchable directory listing more than 14,000 local REALTORS with more than 250 years of combined experience in the real estate business. We are an A+ rated REALTOR by the Better Business Bureau (BBB), and have recently received BBB's A+ grade on the first annual Home Warranty Survey. All of our A+ rated Real Estate brokers are licensed as members of the Real Estate Board of California. Tax Pros — California CPA firm In a nutshell, CPA firms help business owners, both individuals and businesses, manage their tax returns. I.e. we'll help you with your taxes on a monthly basis. What are my Tax obligations? Your tax obligation depends on your federal income tax status, your filing status, your tax filing status, and your taxable income. As a Non-Resident Alien — You don't have to fill out Form 1040NR until after April 18. As a resident alien, you'll need to file as soon as you are legally able to do so.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Salinas California Form 1040 (Schedule C-EZ), keep away from glitches and furnish it inside a timely method:

How to complete a Salinas California Form 1040 (Schedule C-EZ)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Salinas California Form 1040 (Schedule C-EZ) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Salinas California Form 1040 (Schedule C-EZ) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.