Award-winning PDF software

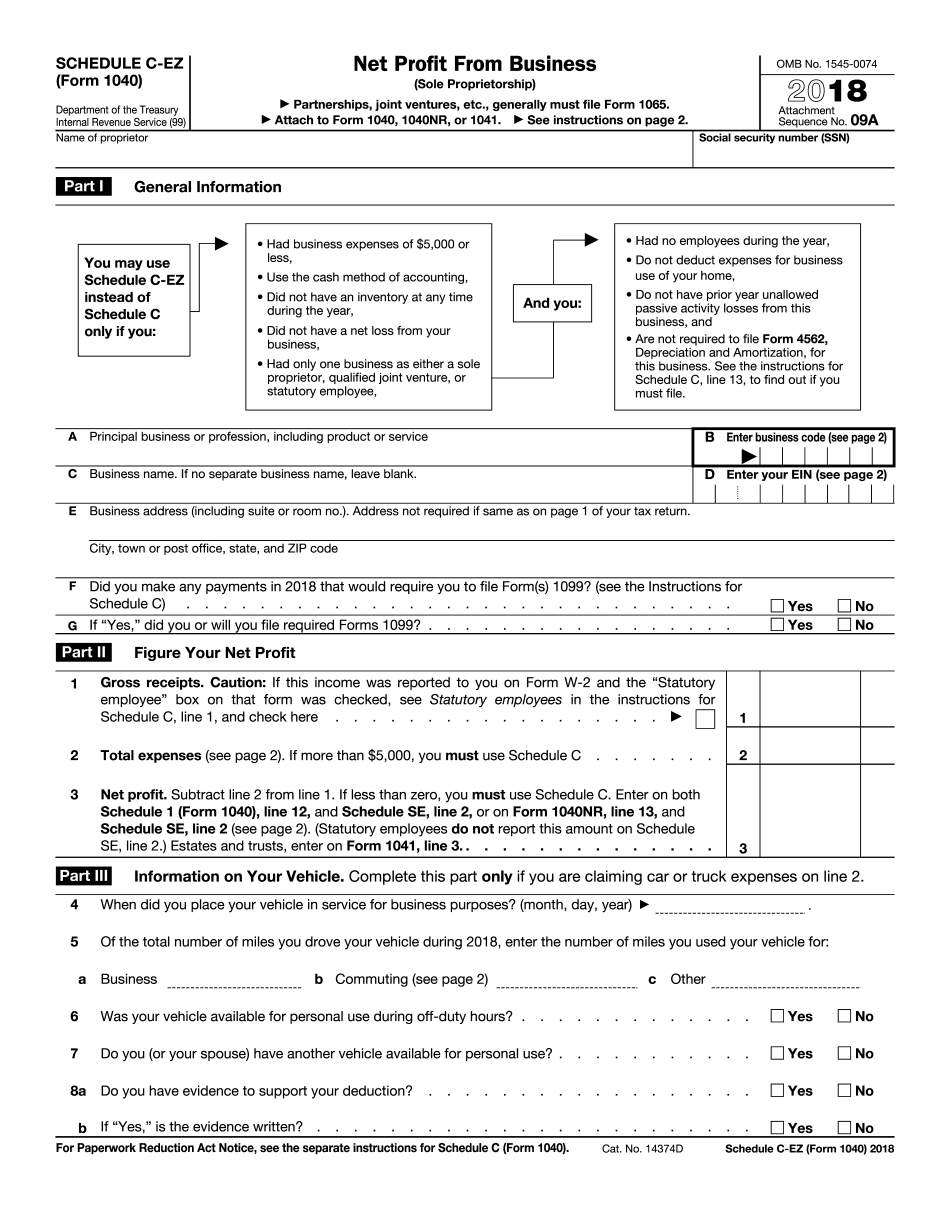

Form 1040 (Schedule C-EZ) Illinois Cook: What You Should Know

In addition, we can also help you complete all other forms and instructions required by the IRS. For more information and to schedule an appointment to come to NYC, contact us at. If you would like your tax advice at a time that's convenient for you, you can contact us at. Please note that it can take up to 3-4 weeks before receiving your Form 1040NR because of the volume of calls we receive. We cannot give advice by email, fax, or telephone. In regard to the deadline for completing your Form 1040NR, you should receive a form with instructions within a week of the time you submit your Form 1040NR. If you haven't received the information about the deadline, check with your tax professional to find out how to complete your 1040NR form online. If you are an attorney representing an independent contractor, the information on this page and the Form 1040-NR instructions are for attorneys who are representing only their clients. If you are a third-party contractor, and you would like to work with an attorney, you should consult with that attorney directly. We cannot help you on the tax questions you have regarding a particular form or instruction. If you are unsure of how to file your 1040NR or if your 1040-NR has been filed incorrectly, you can consult with your tax professional. Our Firm's History of Financial Clout Miller & Company has proven throughout the years to be the best and fastest growing tax firm in New York City. Our clients enjoy our excellent customer service, which is second to none. The work we do is of the highest caliber. We take pride in our firm's ability to help clients with anything taxes, so whether it's your own business, family, or the state. We are a small firm, but our team is very capable of achieving your goals with quality and excellence. Miller & Company is located in the heart of Williamsburg, which has a significant population of independent professionals. As a small operation, we rely on this population to drive our business. Therefore, being in one of the most exciting, multicultural communities in America helps drive our success. That, and our ability to understand and communicate with the local tax population from all walks of life.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040 (Schedule C-EZ) Illinois Cook, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040 (Schedule C-EZ) Illinois Cook?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040 (Schedule C-EZ) Illinois Cook aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040 (Schedule C-EZ) Illinois Cook from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.