Award-winning PDF software

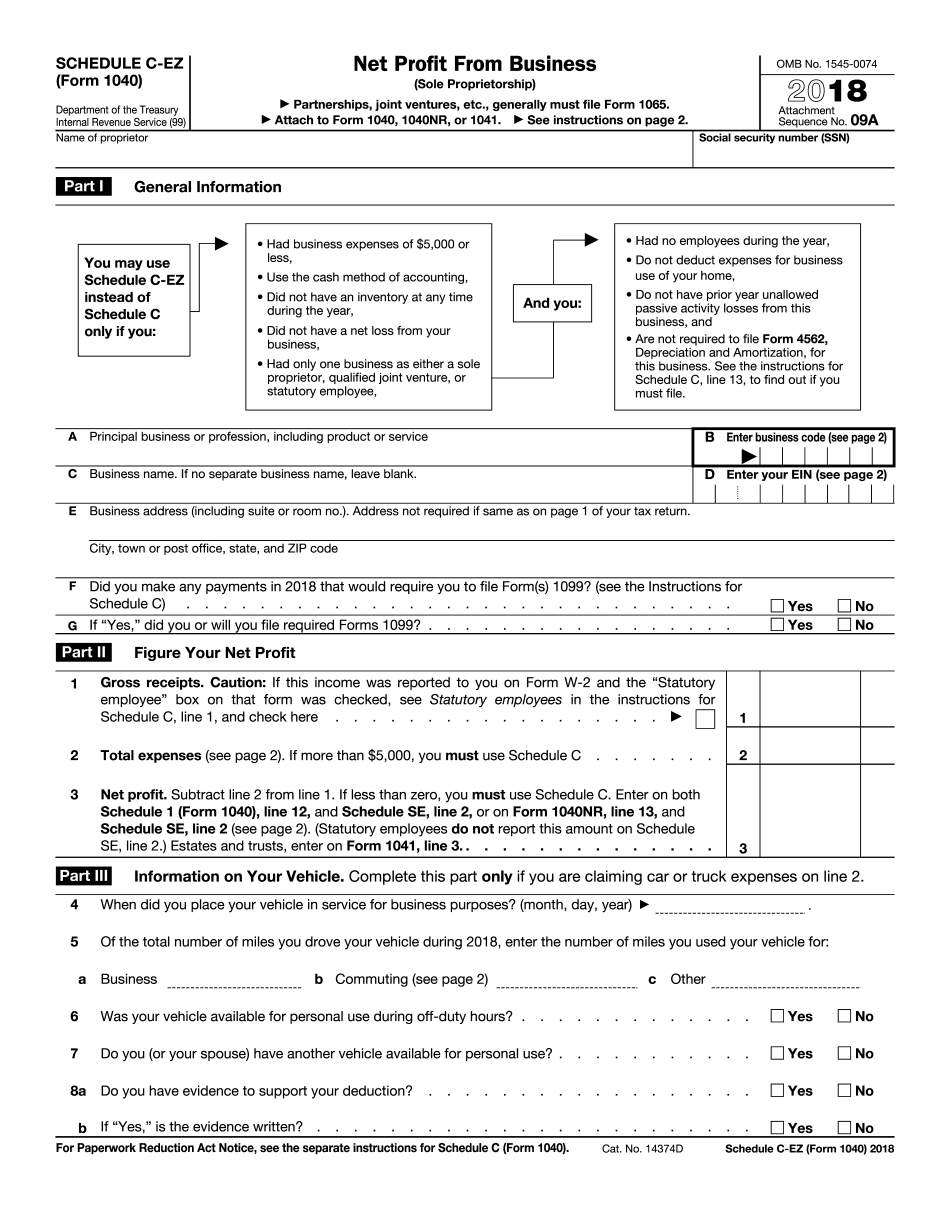

Form 1040 (Schedule C-EZ) MS: What You Should Know

Dec 01, 2025 — For the following business year only, you must complete a Schedule C and/or C-EZ if you have more than 2 million in gross profit: • Schedule C-EZ to report your full business income or • Schedule SE to pay yourself Self-employment Income The following are the most common types of business expenses for small businesses: Sales and Sales Expenses • Direct marketing expenses to sell products, services or property Marketing: Direct marketing activities for which you receive payment other than your regular monthly remuneration. You also can receive credit for up to 30% of direct marketing costs incurred for the current year. The current year has 6 months, and the credits and the number of months in your sales cycle (excluding the 12 months to finish the year) also must be worked out. • Marketing of goods or services used or intended for sale by a manufacturer or supplier to the manufacturer or supplier's customers. Generally, marketing costs do not count as self-employment income to the extent that they are based on your sales and use of the goods or services; or on the proportion you receive in remuneration for your use of the goods or services. • Distributions paid to you for the acquisition, storage, or use of any property used or intended for sale by a manufacturer or supplier to the manufacturer or supplier's customers. • Advertising: Cost of printing, printing and other similar expenses to place or place an advertisement in a newspaper, magazine, periodical, catalog, brochure, or similar publication, or for any other similar type of advertising that you purchase or acquire. These expenses do not include other costs that you incur from advertising, but that involve no sales. For example, suppose you have an hourly rate of 25 per hour that you must pay the publisher on every issue they publish. The publisher sells 12 magazines at a cost of 5000. You would pay 4000 for the first 3 issues, and 1000 for the last 2. No deductions for advertising, including the 1000 for the first 3 issues, can be taken from this business expense. The 2025 for the last two issues would also be taken into account. If there are other advertising-related expenses, you can combine several costs in a single expense for purposes of total expenses. See the instructions for Schedule C(PDF) for more detail and illustration.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040 (Schedule C-EZ) MS, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040 (Schedule C-EZ) MS?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040 (Schedule C-EZ) MS aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040 (Schedule C-EZ) MS from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.