Award-winning PDF software

South Dakota Form 1040 (Schedule C-EZ): What You Should Know

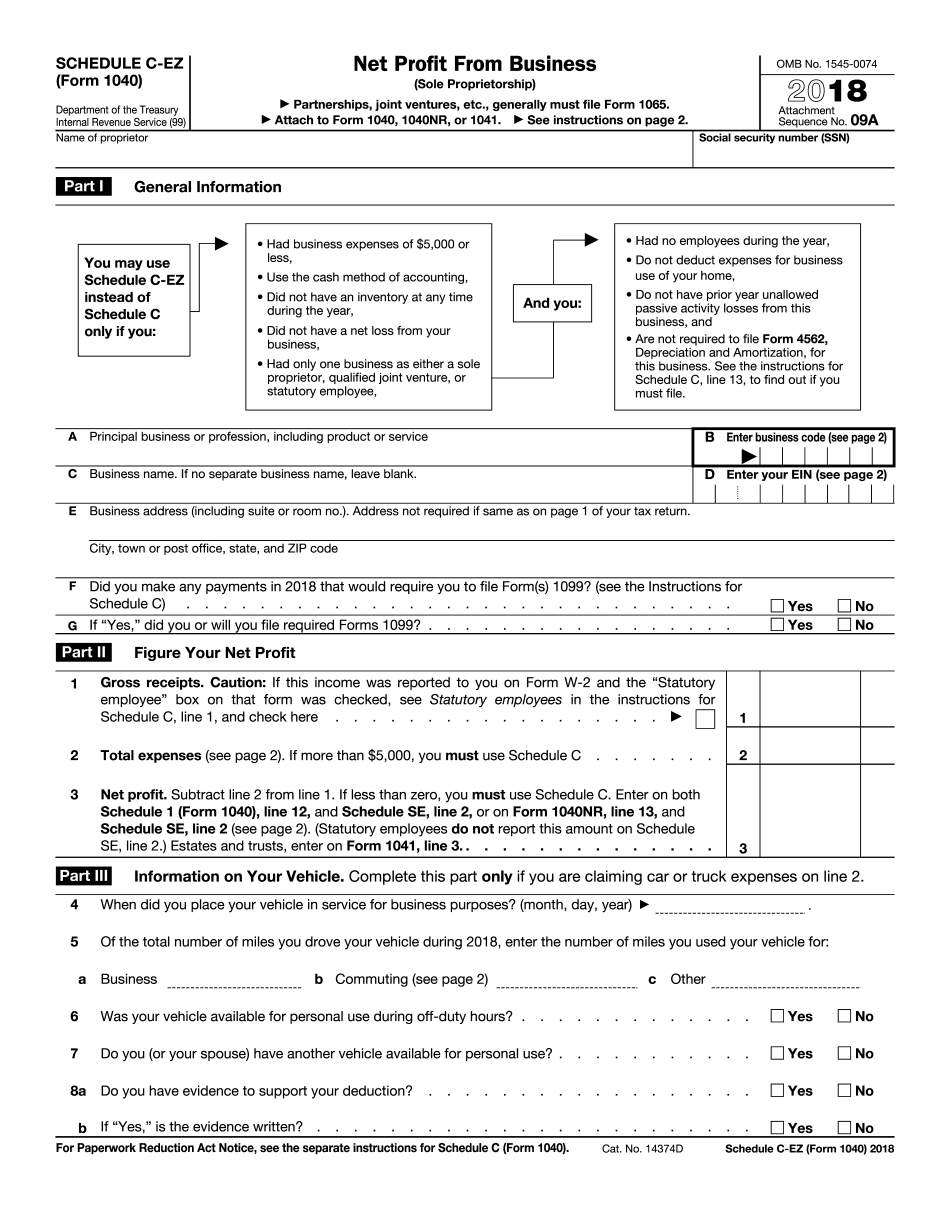

April 17 of any year. For those states that recognize April 18 as a legal holiday, we continue to observe it in all North Dakota offices. 2022 Schedule C (Form 1040) — IRS Go to for instructions, the latest information, and the current tax forms list. For more information, go to Do you wish to register to Vote in North Dakota? If you do not wish to register to vote by mail, you may register to vote on Election Day by filing an individual information ballot (Form NSF 11) at your election office. For information on voting by mail, see our voting by mail page or contact your county board of election. 2022 Schedule C (Form 1040) — IRS Go to for instructions and the latest information, and for a current list of state income taxes. Did you report income on the prior year North Dakota income tax return? If not, you must file another type of federal income tax return called Schedule C (Form 1040). Schedule C (Form 1040) is completed by a taxpayer's sole proprietor, partner, partner in a limited partnership, individual, business or corporation that has no employees but has income from carrying on or engaged in an activity which requires the taxpayer to pay federal income taxes (for example: you operate a trucking business). You may see several words after the word “Form”... Schedule C (Form 1040). To find income tax information for North Dakota, enter the name of the person or business you filed for tax purposes. The best source of that information is either your state income tax return or an accountant's estimate for the taxable year if you have one. It is your responsibility to keep accurate records of income and payments, even if you file Form Schedule C (Form 1040). Some taxpayers may pay some of their state income tax to the state. For information on paying your North Dakota state income taxes, contact your North Dakota income tax bureau by phone at, or by mail at the North Dakota Bureau of Revenue, P.O. Box 2, Hawaiian County, ND 80301. The forms and instructions for these forms are available from the North Dakota Office of State Tax. For more information on the North Dakota income tax, contact the North Dakota Department of Revenue.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete South Dakota Form 1040 (Schedule C-EZ), keep away from glitches and furnish it inside a timely method:

How to complete a South Dakota Form 1040 (Schedule C-EZ)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your South Dakota Form 1040 (Schedule C-EZ) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your South Dakota Form 1040 (Schedule C-EZ) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.