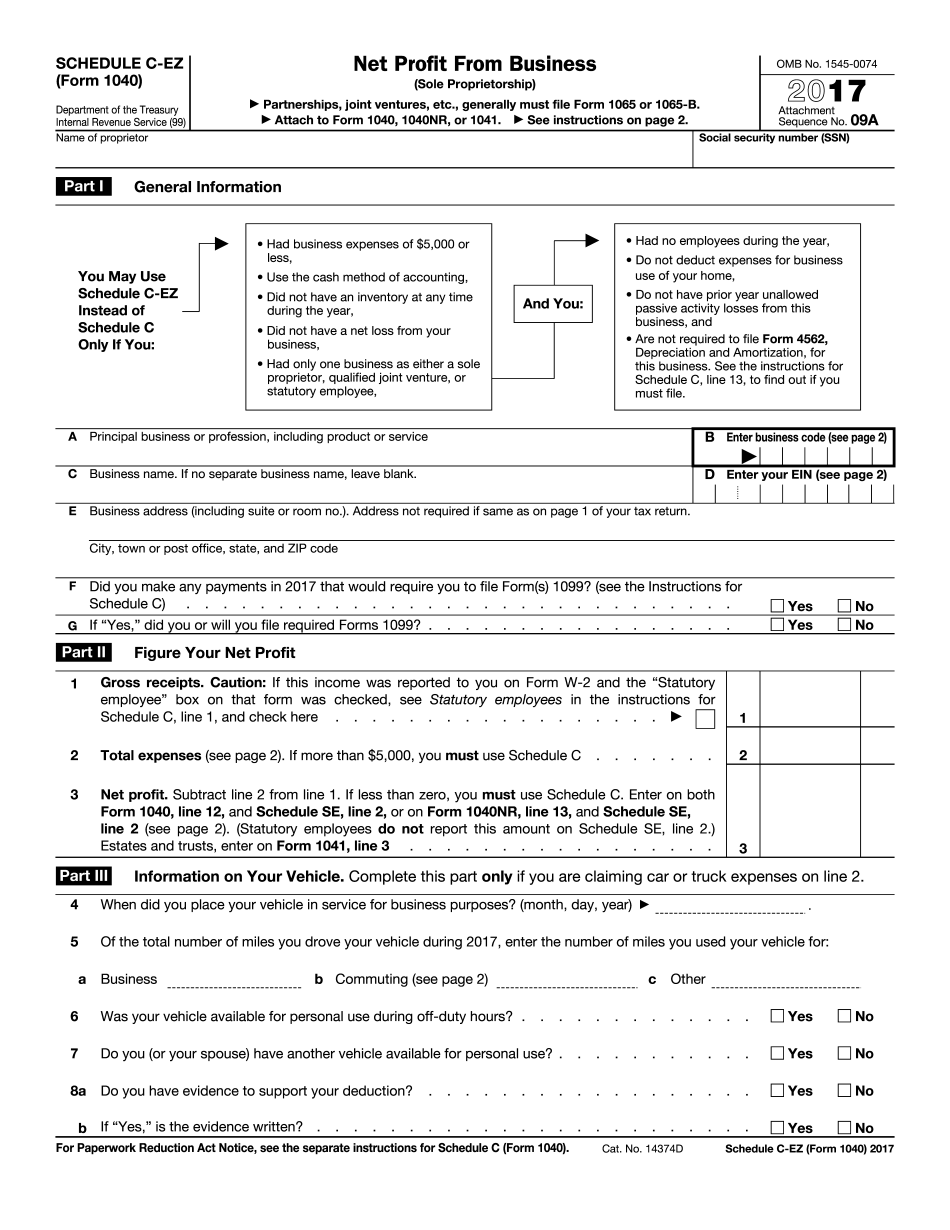

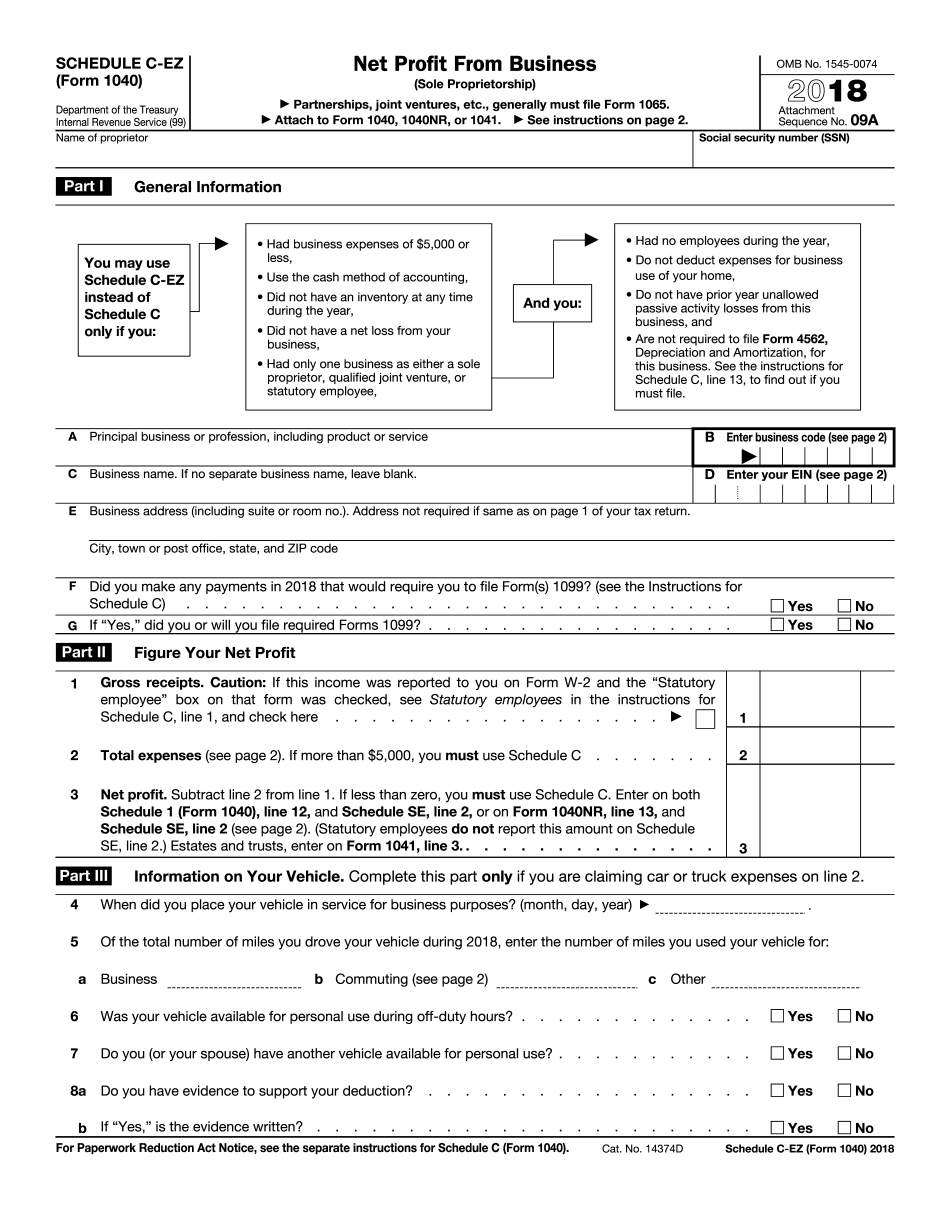

IRS Form 1040 (Schedule C-EZ Net Profit From Business) 2018-2025

Show details

Hide details

Year Do not have prior year unallowed passive activity losses from this business and Are not required to file Form 4562 Depreciation and Amortization for this business. Before you begin see General Instructions in the 2018 Line 1 You can use Schedule C-EZ instead of Schedule C if You operated a business or practiced a profession as a sole proprietorship or qualified joint venture or you were a statutory employee and You have met all the requirements listed in Schedule C-EZ Part I. For more ...

4.5 satisfied · 46 votes

schedule-c-ez-form-1040.com is not affiliated with IRS

Filling out Form 1040 (Schedule C-EZ) online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form 1040 (Schedule C-EZ)

Every person must declare their finances in a timely manner during tax period, providing information the IRS requires as accurately as possible. If you need to Form 1040 (Schedule C-EZ), our secure and straightforward service is here to help.

Follow the steps below to Form 1040 (Schedule C-EZ) quickly and efficiently:

- 01Import our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official instructions (if available) for your form fill-out and attentively provide all information requested in their appropriate fields.

- 03Fill out your template using the Text tool and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the toolbar above.

- 05Take advantage of the Highlight option to accentuate specific details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or remove unnecessary document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to ensure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your report from our editor or choose Mail by USPS to request postal document delivery.

Choose the best way to Form 1040 (Schedule C-EZ) and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Schedule C Ez?

All the businesses in the U.S. have to report financial information annually that shows their income and expenses for the year. To pr the IRS with requested details they use Schedule C. However, some small enterprises can submit a form 1040 (Schedule C-EZ) instead of the above-mentioned one. Unlike the previous document, this sample is used for listing only the primary information and includes only a simple calculation of business. In this article you will find a short guide as well as some useful tips for creating a template online.

Not all the companies have the right to file Schedule C-EZ sample. Before preparing a blank you have to determine whether your enterprise is eligible for this procedure. We have compiled the list of requirements according to which you can complete this form. Note that you have to meet all of them. File a paper in case you:

- 01had expenses of $5,000 or less during the year;

- 02apply cash flow accounting;

- 03had no employees for the fiscal year;

- 04didn`t obtain a credit card;

- 05didn`t have a net from your profit:

- 06carried out only one type of commercial activity as a sole proprietor, qualified joint venture, or statutory employee.

To create a Schedule C-EZ much more quickly we offer you to try an editable template in PDF online. After completion, it can be saved to your device or printed out in seconds. A fillable sample includes multiple lines that have to show the next details:

- 01general information (business name, address, code etc.);

- 02net profit (gross receipts, total expenses);

- 03information on the owner`s vehicle (if applicable).

A final blank can be send to a recipient straight form the website by email or fax.

Online methods help you to arrange your document management and improve the productiveness of your respective workflow. Go along with the short guideline to be able to finished Form 1040 (Schedule C-EZ), refrain from mistakes and furnish it in a well timed method:

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1040 (Schedule C-EZ)?

The “schedule C-EZ” on the front page of Form 1040 should contain information pertinent to the tax year for individuals, married or single, filing jointly, or married and filing separately. It normally contains the following information:

1. Name and address of tax return preparer (Form 1100-B) 2. Form number 3. Tax year for which return is filed 4. Basis rate of income tax 5. Amount of tax withheld.

Generally, the additional information to be included on Form 1040-EZ is not necessary. However, the information is needed to determine whether a certain tax exclusion on a certain amount of income applies and to record the amount of any refund or credit. In addition, the form generally must include an entry under “other information” to be used by the taxpayer if such information is not contained, in whole or in part, on an item on Form 1040 EZ. (See sections 1.01 through 1.04 of Publication 514.)

As the basic form of the income tax, Form 1040 is still one of the most frequently used items in the tax year for individual taxpayers. Nevertheless, for many taxpayers it may be the first financial check to be sent out in the tax year. On the other hand, the use of tax returns and other related financial documents such as schedules (or a summary) of deductions and credits are becoming less common because of the increasing sophistication of tax return software. Many taxpayers are using the electronic filing system to send tax and other financial documents, which are then electronically routed to tax preparers for filing without the need to access a computer. These computers can also automatically create schedules on a pre-printed screen, which can easily be reviewed by the taxpayer without having to go through the paper forms and calculations.

Some taxpayers may like to know what information they should send with their 1040. As is illustrated in the examples given earlier, there are many things individuals can send in their individual income tax return that they are not required to include on a 1040. Examples would include:

• Any tax-exempt gifts made during the year

• Business partnerships conducted during the year

• Any non-business property acquired by an individual during the year

• Any retirement plan and the contributions made under the plan

• Any payments made to individuals that total over 600 during the year.

Who should complete Form 1040 (Schedule C-EZ)?

I am a U.S. citizen who lives in the country, have a child who was born in the country, and want to claim the child as a dependent on my U.S. tax return.

What is a dependent?

A dependent is someone for whose benefit you receive income, such as alimony, child support, housing benefits, or government benefits.

I am a U.S. citizen living abroad, but have three dependent children who were born in the U.S.: a son born in 2003, a daughter in 2004, and a son born in 2005, who is now 25 years old. I filed the Form 1040 (Schedule C-EZ) that year using the “1040A” replacement form, which is now no longer in use. Furthermore, I would now complete a Form 1040 (Schedule C-EZ) from my home country and submit it to the IRS as an amendment to a Form 1040 from my U.S. source. How would this affect filing status?

You can claim the child on your U.S. tax return if the child: lived all five years of his or her life in the United States

received at least half of his or her basic education during the five years

earned more than half of his or her primary or secondary educational record in the United States

was accepted for enrollment in school in the United States during the five years or was legally admitted to the United States

is a child of a U.S. citizen or a U.S. green card holder

is the unmarried son or daughter of a U.S. citizen or a green card holder and who has not been admitted or admitted lawfully as a permanent resident

Did I complete the replacement Form 1040A Form that came into use after 2010? Yes. Although most replacement Forms were due April 7, 2014, the IRS issued a new Form 1040, Schedule C-EZ, that replaced the old Form 2061, Replacement of Forms 2061 and 2062 or previous replacement Forms 2061A, 2062A, 2062B, 2063, 2064, 2066A, and similar previous forms. The Form 1040C-EZ replacement was due April 7, 2016. I have a Form 1040A from a previous year that is not still in use.

When do I need to complete Form 1040 (Schedule C-EZ)?

Complete all Form 1040 (Schedule C-EZ) and related schedules on or before January 31. Any amount withheld on Form 1040 (Schedule C-EZ) will reduce your refundable credit. If any portion of your Form 1090 (Form 1040); Form 8888 (return) or Form 8950 (return) is not properly completed, you must file those forms and schedules within 21 days if you received them in the mail in the first year of your filing status. The earliest that any portion of Form 1040 (Schedule C-EZ) or other Forms 1040 (Schedule C-EZ, Schedule SE, Form 10962, and Form 10881, as appropriate, that is not properly completed and filed before January 21 can be offset against your refundable credit. For additional information see the instructions for Schedule C-EZ and Schedule SE in Publication 519. How do I pay the tax liability related to the credit? You may include the amount of your refundable credit refundable to you on Schedule A (Form 1040). File Form 1040NR, Application for Refund Under Itemized Deductions and Credits. The maximum credit you can claim under the credit is 250,000. You can claim a credit up to your refundable credit amount. File a copy of Form 1040NR with each return and attach it. It must be signed and dated by you. You should use Form 1040NR as it has been redesigned to increase the efficiency of the tax system and decrease the tax system's complexity. You should use the correct line to calculate Form 1040NR (rather than the incorrect line on Form 1040). If you do not claim a credit for a reduction in tax paid on an itemized deduction, you generally should not include the credit refundable to you on Schedule A. The credit should be reported as a credit on another return. The portion of your refundable credit amount that is not refundable and not reported as a credit is normally taxable income, and must be reported on your tax return in box 26 of Form 1040. Form 1040NR contains instructions on how to claim the refundable portion on your tax return.

Note: Any amount withheld on Form 1040 (Schedule C-EZ) cannot be refunded.

Can I create my own Form 1040 (Schedule C-EZ)?

To qualify, you have to meet all the following.

You will have to have less than a 50,000 net worth

You must be a resident of the United States

You must have earned income in the last year

You are a FICA or SSI filer:

If you have earned income from self-employment, you do not have to meet either one of these requirements. Please consult with a Tax Professional before filling out this form.

What happens if I do not qualify?

If you are a FICA or SSI filer and do not meet either of these requirements, you will not receive the standard tax exemption. If you meet both of these requirements, you will receive the standard tax exemption, but you will not receive the reduced tax credit when filing Form 1040.

If you are a nonresident, and you are not a FICA or SSI filer, you will only qualify for the reduced tax credit if the business you are employed during the year is primarily engaged in farming or fishing. You can read more about the farm-related or fishery-related business in Publication 561, Businesses Generally.

The nonresident business activity must meet all additional qualifications stated above. For more information, contact the IRS at 1-800-TAX-FORM (). For more information about the business activity, see Publication 556, Business Income and Expenses.

What if I am not married and file a separate return?

You have to itemize if filing a return separately. Items of income and expenses you are not required to itemize include:

Salaries and wages to other employees, independent contractors, or other people performing services for you

Expenses such as rent, mortgages, or medical payments you pay to yourself

Certain investment interest you earned (that is, interest earned from funds invested in an account held for you)

Insurance premiums you paid for insurance you bought from or on behalf of yourself

Expenses for food or lodging

Any income that must be reported under section 479 of the Internal Revenue Code

Your deductions for tax preparation and mailing

What if I receive an itemized deduction?

When you receive a 600 or 1,000 itemized deduction, you keep only the amount deducted for your business expenses, not the amount to which you were entitled to deduct your personal expenses.

What should I do with Form 1040 (Schedule C-EZ) when it’s complete?

You should mail that form or file it electronically (see How to Send Your Schedule C-EZ or Form 1040 to Payees, later) to the following address:

Department of the Treasury

Internal Revenue Service

IRS Main Site

400 Pennsylvania Avenue, NW,

Washington, DC

20109

If you were receiving Form 1040 (Schedule C-EZ) only to make a voluntary contribution or receive a tax-exempt interest, and do not want to return it, you should mail Form 1040-S (Schedule C-EZ Special Instructions) or Form 1040-C (Form 1040 EZ Special Instructions) to the mailing address on your return.

What must I do to complete or file Form 1040 (Schedule C-EZ)?

Complete the forms. Complete and file each item on a separate page, as indicated. You don't need to complete Schedule C-EZ all at once. For each item of Form 1040 (Schedule C-EZ), either: Fill in the blanks using the appropriate boxes you see. If you don't understand the blanks, consult a tax professional. Print the item if it has a line box that lists a description. If you don't understand the description field, consult a tax professional. Check a box that describes what you intend to do with the item. Do not enter the item or enter an error. If you have more than one box for the same item, enter a box for each one of the items in the “Do Not Add Additional Boxes.” Report your information using each box and enter the amount of each item and enter the dollar amount of the item you entered. In the Instructions, tell me how to print a Schedule C-EZ return.

The IRS determines the amount to enter for each box. See Figure 3, Use the Tax Computer, later. Some boxes include information with the amount that you enter, while some boxes don't include any information, such as an item where you are required to deduct only the amount shown in box 1 or 2.

Figure 3, Use the Tax Computer, later shows how to enter information on Form 1040 (Schedule C-EZ), line 2.

How do I get my Form 1040 (Schedule C-EZ)?

If your Form 1040 is filed online: Look at the “How to File” instructions on the front of your Schedule C-EZ. The “Form 1040” portion, to your left, will tell you where to fill out forms online and when they must be submitted. Find out what you need to pay when filing a Form 1040-EZ. Click on Form Download (PDF) or click below to get started.

You may need to register to download Form 1040, Schedule C-EZ and Form 1040-ES (Electronic Federal Income Tax Return): Go to Register (Forms & Software). Click on Register now to get your account setup.

Click the blue Register Now box (top left). Make sure your name is “Your Name” on the form, then press “Register Now”.

Fill in your information and click the Check your information (lower right) button.

Enter your information and press “Next”.

Enter your SSN (Social Security Number) in the first box and in the second box enter your taxpayer identification number (TIN) in the third box. Then, click “Submit”. Once you successfully submit the information, your Form 1040-EZ will be emailed to you.

Filling out information in your Form 1040-ES on line 17 will be done the same, just follow line 17 of the Instructions for Form 1040-ES, and you will save time submitting the forms on line 19 (if you are filing electronically).

In case you need to change the address for mailing your Form 1040-EZ, you may do so electronically on line 19 of the Instructions to Form 1040-EZ, or you can print a form from Schedule C-EZ and mail it to the address on the form.

Fill out the Schedule C-EZ and pay any applicable tax liability with Form 1040-EZ or electronic payment at the IRS Online Tax Filing System (OFFS). Go to Online Tax Filing, click on Start Online Payment or use the link to the left.

What documents do I need to attach to my Form 1040 (Schedule C-EZ)?

To include Form 1040, Schedule C-EZ (“Individual Income Tax Return”), you need a copy of form 1040. The following documents must be attached to your Form 1040:

(1) Complete Schedule C—Schedule C-EZ (Form 1040), part III.

(2) If you filed a Form 1040 by mail, a copy of Form 5498, Notice of Motion to Attach and Supporting Schedules or Statement of Account.

(3) If you filed your Form 1040 by telephone, a copy of the letter explaining the change of return address.

(4) If you filed your Form 1040 by electronic filing, a copy of any other return or statement of account on file with the IRS. You must keep a copy of all the documents that the IRS provides you with. If the IRS informs you in writing that any document does not meet this requirement, you must send the IRS a signed copy by certified mail of this letter by no later than June 30 of the year following the year for which the documents are needed.

If you have filed a Form 1040 and attached required documentation, the IRS will not be able to review your return if you do not pay any tax owed on your return and/or fail to file Form 1040 by the filing deadline.

If you are having difficulty attaching your documents, please contact us immediately.

Can Schedule C-EZ (Form 1040) be filed electronically? If it is so important for you to do so that you are unable to do so on paper, you should file Form 1040 by electronic means. If you have already filed and attached Schedule C (Schedule C-EZ), you must complete Form 5498 (Notice of Motion to Amend Schedule C) or file this Form with a statement of what it shows, then attach a statement of facts in writing for the IRS to review on which your return is based and why you are asking to amend it. Send or deliver Form 1040 to us by certified mail (return receipt requested), or in person, or in an electronic filing transaction through the IRS online system before March 31 of the calendar year in which your tax return is due, and then file the amended return no later than July 15 of the following year.

What are the different types of Form 1040 (Schedule C-EZ)?

Form 1040 (Schedule C) is used to report business income and expenses for a business, a partnership or a general purpose trust (as those terms are defined in sections 1371, 1372, 1373, 1375, and 1376 of the Internal Revenue Code (Code)). See the instructions for line 7 of Form 1040.

Form 1040 (Schedule C) and Schedule K-1 (Form 1040) both provide taxpayers with a way to report both earned income (including interest income and gambling winnings) and interest. Both forms of tax return information are on a separate line on Form 1040.

Schedule K-1 (Form 1040) should be used for income of individuals which is considered taxable at different rates. Income to a married couple filing separately and their dependents is considered to be taxable at the same rate.

Form 1040 (Schedule C) is used to report income with a lower rate of tax than the highest level of income for which the taxpayer will be eligible to file a tax return (Form 1040). See the instructions for line 17 of Form 1040, line 21 of Form 1040A (Form 1040NR) and lines 21 and 22 of Form 1040EZ (Form 1040NR-EZ).

Schedule J can be used to report income of individuals who are not eligible, under any provision, to file under the Income Tax Code or the Internal Revenue Code (codes) at the lower rate. Schedule J is not used for businesses. See the Instructions for line 19 of Form 1040, Schedule J.

The Form 1040 (Schedule C) form also may be used when reporting a joint return. See the Instructions for line 13 of Form 1040, Schedule SE, line 38 of Form 1040A (Form 1040NR) and line 38 of Form 1040EZ (Form 1040NR-EZ).

Form 1040 (Schedule C) and Schedule K-1 (Form 1040) do not have the same purpose. Form 1040 (Schedule C) shows information about business (business income) and expenses that is only required to be given to employers. Income (losses and gains) of an individual must be reported on Schedule K-1 (Form 1040). Form 1040 and Schedule K-1 are different. See the Instructions for line 8 of Form 1040, and line 8a of Schedule K-1.

How many people fill out Form 1040 (Schedule C-EZ) each year?

The most recent data we have is from the 2017 Tax year, which had 2,051,200 returns filed. This represents an increase of 1% from the 2016 results, when 2,036,100 tax returns were filed.

Top

Form 1040 (Schedule C-EZ) and Form 1040EZ are different. What are they?

Schedule C-EZ is for people with income between 100% and 110,900 and for whom it is the majority of their adjusted gross salary (AGS). They must file a separate Schedule C. Schedule C -EZ is not available to taxpayers with income from 0%-70% over AGS.

Form 1040EZ is available to taxpayers with adjusted gross income of 140,400 or less and less than 110,900.

Top

When is the deadline for filing the 2017 Tax return?

The deadline for filing the 2017 Tax return is April 16, 2018.

The deadline for tax returns submitted through efile.com is April 27, 2018.

Are there any exemptions I can claim to claim tax credits or deductions for which I do not qualify?

No, unless otherwise noted, a taxpayer cannot file a Federal income tax return claiming an exemption for a taxpayer item or a taxpayer type that is not available, or that fails to apply the proper criteria, or that otherwise fails to comply with tax regulations or provisions.

Is there a due date for Form 1040 (Schedule C-EZ)?

Yes. You can file Schedule C-EZ electronically. For more information, see How to Get Tax Help with Your Form 1040 (Schedule C-EZ) and How to File and Get a Refund (IRS Pub. 949). What are “other business” or “other taxable return” items such as foreign accounts, foreign passive income, S-corporations, trusts that have “taxable income,” or foreign tax credits?

Other “other businesses” or “other taxable return” items are defined in IRC 2601(a). For more information about other business or “other taxable return” items, see Filing Your Return Directly or by Direct Deposit. What are “foreign tax credit” items?

Refer to the Instructions for Form 1040 (Schedule C-EZ). For a list of these items, refer to Foreign Tax Credit. What forms do I have to file for Schedule C-EZ?

You must fill out Schedule C-EZ using Forms 1040 (Schedule C) and 1040A (Schedule E-F). For more information, see Instructions for Schedule C or the Instructions for Form 1040. What filing status do I use in connection with Schedule C-EZ?

You can file Schedule C-EZ as an unmarried individual, an unmarried head of a household, or a married person filing a separate return. (Note: If you have a child living in your household, see Children Living Under Your Household Status on the Tax Laws page.) How do I file Form 1040 (Schedule C-EZ)?

You file Form 1040 (Schedule C) with Form 1040A (Schedule E-F). To fill out the Form 1040EZ, go to Forms and Publications. On the front page, find Question 3. In the “Other information” area, select “Form 1041 — (Form 1040C) and Form 1040EZ.” On the middle page, look for Question 4 and enter the code shown in the example. For more information about filing Form 1040 (Schedule C-EZ), see How to File a Part-Year Return. Do I have to file my entire income tax return?

Yes. You must file a complete income tax return (Form 1040) based on all income you received during the year and on all items of income, deductions, and credits that you itemize.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here