Award-winning PDF software

Form 1040 (Schedule C-EZ) online Baton Rouge Louisiana: What You Should Know

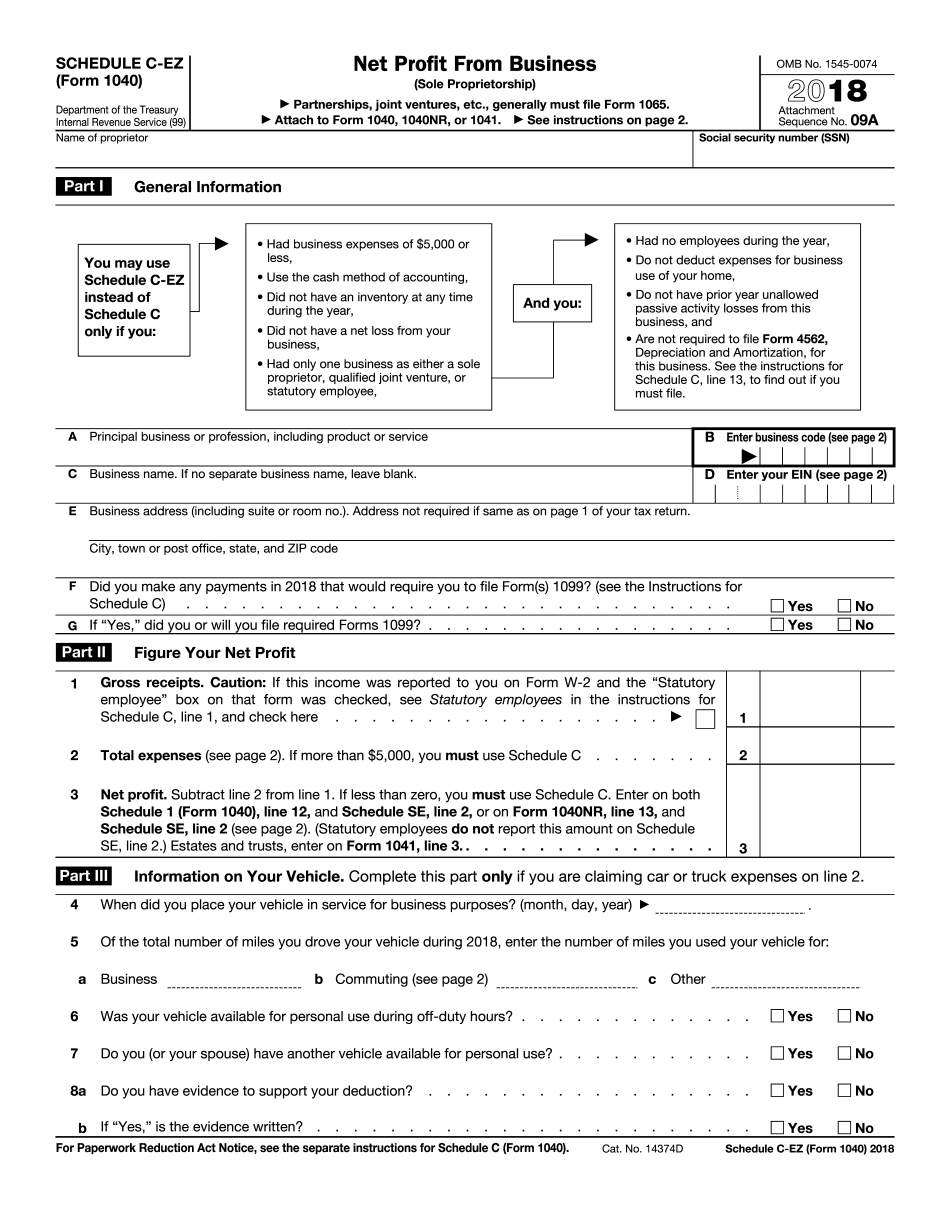

A business includes a sole proprietorship or partnership. Forms are to be submitted in triplicate to the office of the tax collector where the business is located. No tax return or form is acceptable as proof of filing. However, the following may be filed: (1) the current year U.S. tax return (Form 1040); (2) schedule C tax return; (3) the tax return for the preceding year; (4) Form 8886 if Form 1040 is required and (5) any other form authorized by law. Forms are to be signed by at least ONE of your partners or partners in the business. There must be complete and separate signature to each Form. Filing the forms required by section 6103(h) is mandatory for tax-exempt organizations or for any qualified electing small business. Form 1040 should be completed by each person named in such section of tax code who is liable for the tax to the business. If no partners sign Form 1040 for a business, the sole proprietor must complete it. If the business has no partners, another partner can sign the form or prepare a signed copy of the form for the business. Business-Name and Address in List of Businesses (Form 1040)-- (1040) If you do not file Form 1040 because of a general failure to file, you may wish to contact the Taxpayer Assistance Center. Telephone. Form 1040 must include the current year tax return shown on page 1 or 2 of the original return. (The IRS recommends that you file a corrected copy.) You must complete the name and address of the owner/operator of the business. The signature of the person signing the return or an original signature must be witnessed by one or more persons. There are several problems in completing Form 1040. Your form should specify if the business is: (a) a sole proprietorship or partnership, or (b) both: If you are a sole proprietor, you must have one of the partners or partners in the business sign Form 1040.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040 (Schedule C-EZ) online Baton Rouge Louisiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040 (Schedule C-EZ) online Baton Rouge Louisiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040 (Schedule C-EZ) online Baton Rouge Louisiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040 (Schedule C-EZ) online Baton Rouge Louisiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.